Credit scores play a pivotal role in your financial life, influencing your ability to secure loans, credit cards, and even rental agreements. While hard inquiries are just one of many factors that affect your credit score, they can still make a difference, especially if multiple inquiries occur within a short period. Lenders view hard hits as a sign that you may be seeking new credit, which could indicate financial instability. However, the impact of these inquiries is often misunderstood. By the end of this article, you'll have a clear understanding of how many hard hits affect credit score, how they work, and what you can do to protect your credit standing. In today’s fast-paced financial landscape, staying informed about your credit health is more important than ever. Whether you're planning to apply for a mortgage, car loan, or credit card, knowing the ins and outs of hard inquiries can save you from unnecessary credit score dips. This article will delve into the nuances of credit inquiries, provide actionable tips to manage them, and answer common questions like "How many hard hits affect credit score?" and "What can you do to minimize their impact?" Let’s get started on your journey to mastering credit health!

Table of Contents

- What Are Hard Hits and How Do They Work?

- How Many Hard Hits Affect Credit Score?

- Are Hard Hits Permanent on Your Credit Report?

- What’s the Difference Between Hard and Soft Inquiries?

- Strategies to Minimize the Impact of Hard Hits

- How to Check Your Credit Report for Hard Hits?

- Common Misconceptions About Hard Hits

- Frequently Asked Questions About Hard Hits

What Are Hard Hits and How Do They Work?

Before diving into the specifics of how many hard hits affect credit score, it’s essential to understand what hard hits are and how they function. A hard hit, or hard inquiry, occurs when a lender reviews your credit report to make a lending decision. This typically happens when you apply for a loan, credit card, or mortgage. Unlike soft inquiries, which are harmless and don’t affect your credit score, hard hits are recorded on your credit report and can influence your credit score.

Each hard inquiry can reduce your credit score by a few points. While the exact impact varies depending on your credit history, the general rule is that multiple hard hits within a short period can signal to lenders that you’re actively seeking credit. This can raise red flags about your financial stability. For example, if you apply for multiple credit cards in a month, lenders may view this as risky behavior, potentially lowering your credit score further.

Read also:Neal Mcdonough The Versatile Actor Behind Iconic Roles And Memorable Performances

It’s important to note that not all hard inquiries are created equal. For instance, if you’re shopping for a mortgage or car loan, multiple inquiries within a 14- to 45-day window are typically treated as a single inquiry by credit scoring models. This is known as "rate shopping" and is designed to protect consumers who are comparing offers. However, outside of this context, each hard inquiry is treated individually, making it crucial to apply for credit strategically.

How Many Hard Hits Affect Credit Score?

One of the most frequently asked questions is, "How many hard hits affect credit score?" The answer depends on several factors, including your credit history, the scoring model used, and the context of the inquiries. Generally, a single hard hit can lower your credit score by 5 to 10 points. While this may seem insignificant, the cumulative effect of multiple hard hits can add up, especially if your credit history is limited or already shaky.

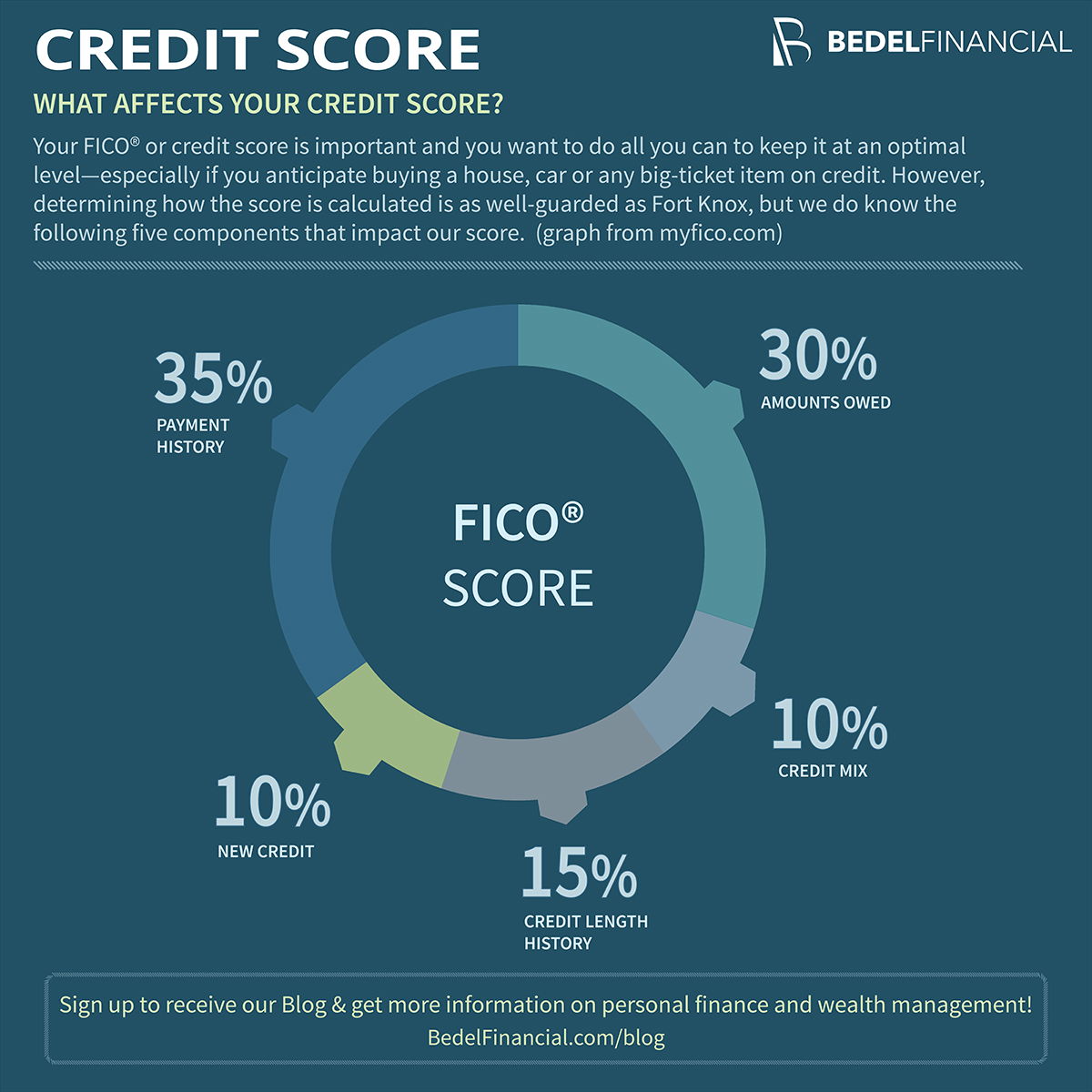

For individuals with a strong credit history, the impact of a hard hit is often minimal. However, for those with a shorter credit history or lower credit scores, the effect can be more pronounced. Credit scoring models, such as FICO and VantageScore, consider hard hits as part of their calculations, but they also weigh other factors like payment history, credit utilization, and length of credit history. This means that while hard hits matter, they are just one piece of the puzzle.

To put it into perspective, here’s a breakdown of how many hard hits affect credit score based on different scenarios:

- 1-2 Hard Hits: Minimal impact, typically a 5-10 point reduction.

- 3-5 Hard Hits: Moderate impact, especially if they occur within a short timeframe.

- 6+ Hard Hits: Significant impact, potentially signaling financial distress to lenders.

What Can You Do to Mitigate the Impact?

If you’re concerned about how many hard hits affect credit score, there are steps you can take to mitigate their impact. First, avoid applying for multiple credit accounts in a short period unless you’re rate shopping for a specific type of loan. Second, monitor your credit report regularly to ensure that all hard hits are legitimate. If you spot any unauthorized inquiries, dispute them with the credit bureaus immediately.

Does the Timing of Hard Hits Matter?

Yes, the timing of hard hits matters significantly. Credit scoring models are designed to recognize rate shopping, so multiple inquiries for the same type of loan within a short period are often treated as one. This is particularly relevant for mortgages, auto loans, and student loans. However, applying for different types of credit, such as a credit card and a personal loan, will result in separate hard hits, potentially lowering your score more.

Read also:Lily Dolores Harris A Comprehensive Biography And Career Overview

Are Hard Hits Permanent on Your Credit Report?

A common misconception is that hard hits remain on your credit report forever. The good news is that they are not permanent. Hard inquiries typically stay on your credit report for two years, but their impact on your credit score diminishes over time. Most credit scoring models only consider hard hits that occurred within the past 12 months, meaning their influence becomes negligible after a year.

What’s the Difference Between Hard and Soft Inquiries?

Understanding the distinction between hard and soft inquiries is crucial for managing your credit health. Hard inquiries, as discussed, occur when a lender checks your credit report for lending purposes. Soft inquiries, on the other hand, happen when you check your own credit report or when a company reviews your credit for pre-approval offers. Soft inquiries do not affect your credit score and are not visible to lenders.

Strategies to Minimize the Impact of Hard Hits

To protect your credit score, it’s essential to adopt strategies that minimize the impact of hard hits. Here are some actionable tips:

- Apply for credit only when necessary.

- Utilize rate shopping windows for loans.

- Monitor your credit report regularly for errors.

- Consider pre-qualification offers that use soft inquiries.

How to Check Your Credit Report for Hard Hits?

Checking your credit report is a proactive way to stay informed about hard hits. You can obtain a free credit report annually from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. Review the inquiries section to identify any hard hits and ensure they are legitimate.

Common Misconceptions About Hard Hits

There are several myths surrounding hard hits, such as the belief that checking your own credit report will hurt your score. In reality, self-checks are soft inquiries and have no impact. Another misconception is that all inquiries are harmful, but as we’ve discussed, rate shopping is an exception.

Frequently Asked Questions About Hard Hits

How Long Do Hard Hits Stay on Your Credit Report?

Hard hits remain on your credit report for two years but only affect your score for the first 12 months.

Can You Remove Hard Hits from Your Credit Report?

Yes, you can dispute unauthorized hard hits with the credit bureaus to have them removed.

Do Hard Hits Affect Everyone Equally?

No, the impact varies based on your credit history and the scoring model used.

In conclusion, understanding how many hard hits affect credit score is essential for maintaining financial health. By adopting smart credit practices and staying informed, you can minimize their impact and protect your credit standing. For more information, visit MyFICO to learn about credit scoring models.