Ordering a Chase checkbook is a straightforward process that can significantly enhance your financial management. Whether you’re a new account holder or need to replenish your stock of checks, Chase Bank offers multiple ways to place an order. With options ranging from online banking to visiting a local branch, Chase ensures convenience for its customers. Understanding how to navigate these methods will save you time and effort, enabling you to focus on what truly matters—managing your finances effectively.

For many individuals, checks remain an essential tool for making payments, especially for rent, utilities, or other recurring expenses. While digital payment methods have gained popularity, checks provide a tangible and secure alternative. Chase Bank, one of the largest financial institutions in the United States, caters to millions of customers who rely on checks for their financial transactions. This guide will walk you through everything you need to know about ordering a Chase checkbook, ensuring you’re equipped with the knowledge to handle this task with ease.

Before diving into the specifics, it’s important to note that Chase offers various customization options for your checkbook, including designs, security features, and delivery preferences. Whether you’re ordering for personal or business use, Chase ensures that your checks align with your unique needs. By the end of this article, you’ll have a clear understanding of how to order a Chase checkbook and make the most of this essential banking tool.

Read also:Cottonsox S The Ultimate Guide To Comfort And Style

Table of Contents

- How to Order a Chase Checkbook Online

- Can You Order a Chase Checkbook Over the Phone?

- What Are the Benefits of Ordering Checks Through Chase?

- Customizing Your Chase Checkbook: Options and Tips

- How Long Does It Take to Receive a Chase Checkbook?

- Is It Safe to Order Checks Online With Chase?

- Frequently Asked Questions About Ordering a Chase Checkbook

- Conclusion: Tips for Managing Your Chase Checkbook

How to Order a Chase Checkbook Online

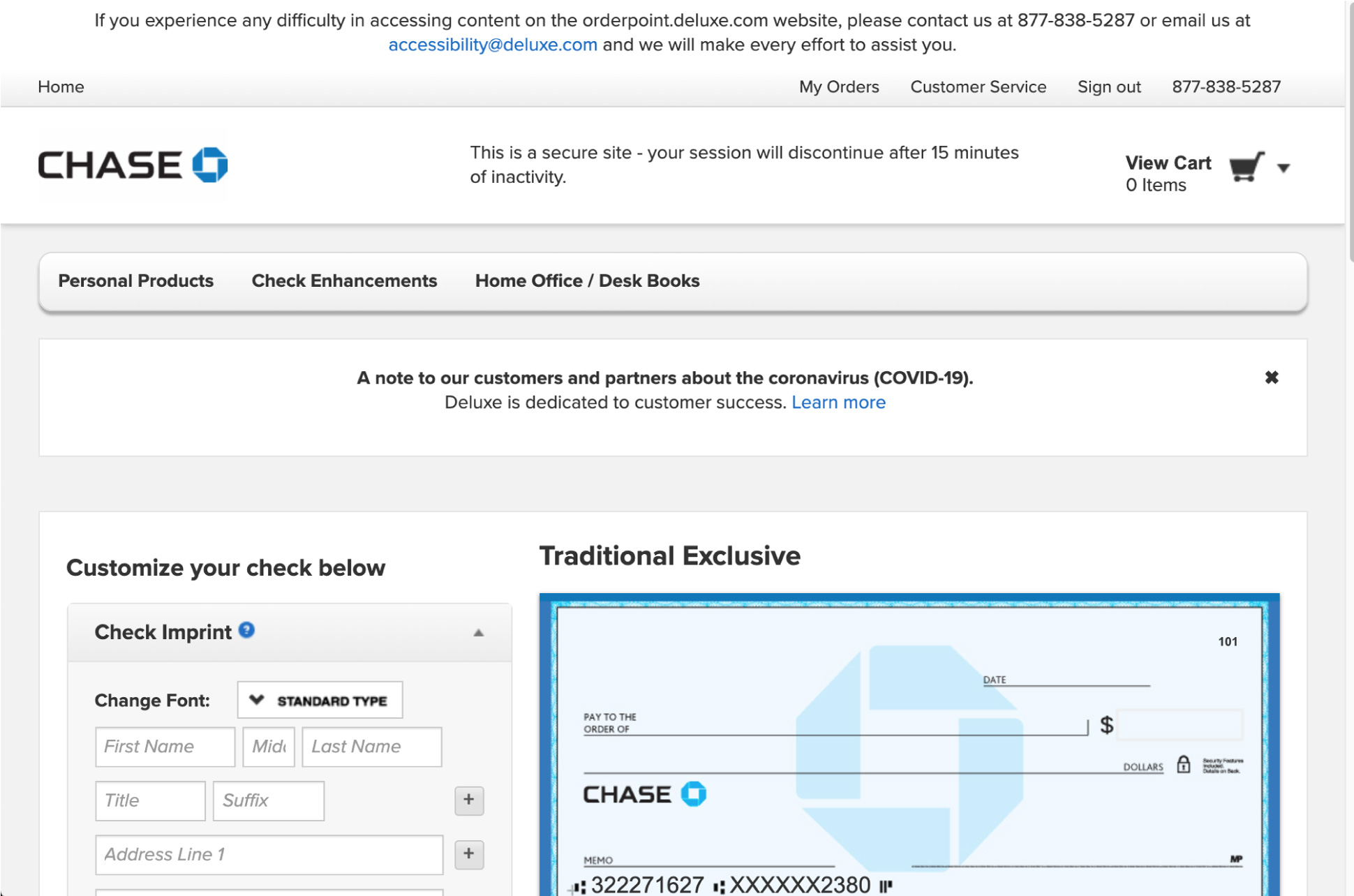

Ordering a Chase checkbook online is one of the most convenient methods available to customers. The process is user-friendly and can be completed in just a few steps. To get started, you’ll need to log in to your Chase online banking account. If you haven’t set up online banking yet, you’ll need to register first by providing your account details and creating a secure username and password. Once logged in, navigate to the “Order Checks” section, typically found under the “Services” or “Account Tools” tab.

Upon selecting the option to order checks, you’ll be prompted to choose from a variety of check designs and customization features. Chase offers a range of templates, including standard checks, business checks, and specialty designs for personal use. You can also add security features like watermarks or microprinting to protect against fraud. After selecting your preferred design, you’ll need to confirm your shipping address and payment details. Chase typically charges a fee for ordering checks, which varies depending on the type and quantity you choose.

One of the advantages of ordering a Chase checkbook online is the ability to track your order in real-time. After placing your order, you’ll receive a confirmation email with an estimated delivery date. Chase partners with reputable check printing companies to ensure high-quality production and timely delivery. If you encounter any issues during the process, Chase’s customer service team is available to assist you via chat, email, or phone. By leveraging the convenience of online banking, you can streamline the process of ordering a Chase checkbook and focus on managing your finances effectively.

Can You Order a Chase Checkbook Over the Phone?

Yes, you can order a Chase checkbook over the phone, and it’s a great option for those who prefer personalized assistance. To place an order via phone, you’ll need to contact Chase’s customer service team using the number provided on the back of your debit or credit card. Alternatively, you can find the contact information on Chase’s official website. Before calling, ensure you have your account details handy, including your account number and Social Security number, as the representative will need to verify your identity.

During the call, the customer service representative will guide you through the process of ordering your checkbook. They’ll ask for your preferences regarding check design, quantity, and any additional features you’d like to include. Similar to the online process, Chase offers a variety of customization options, such as adding your name, address, or business logo to the checks. The representative will also confirm your shipping address and payment method, ensuring that your order is processed accurately.

While ordering over the phone is convenient, it’s worth noting that this method may take slightly longer than ordering online. This is because the representative needs to manually input your details and verify your account information. However, the benefit of speaking directly with a representative is the opportunity to ask questions or address any concerns you may have. If you’re unsure about the customization options or delivery timelines, this method allows you to receive real-time answers. Overall, ordering a Chase checkbook over the phone is a reliable alternative for those who prefer a more hands-on approach.

Read also:Who Is Adam Shulman Discovering The Man Behind The Spotlight

What Are the Benefits of Ordering Checks Through Chase?

Ordering checks through Chase offers several advantages that make the process seamless and reliable. One of the primary benefits is the assurance of quality. Chase partners with trusted check printing companies that adhere to strict industry standards, ensuring that your checks are printed with precision and durability. This not only enhances the professional appearance of your checks but also provides peace of mind knowing that they meet security requirements to prevent fraud.

Another significant advantage is the convenience of multiple ordering options. Whether you prefer online banking, phone assistance, or visiting a local branch, Chase offers flexible methods to suit your preferences. This adaptability is particularly beneficial for individuals with busy schedules or those who may not be tech-savvy. Additionally, Chase’s online platform allows you to save your preferences, making future orders quicker and easier.

Furthermore, Chase provides a range of customization options that cater to both personal and business needs. From selecting unique designs to adding personalized details, you can tailor your checkbook to reflect your style or branding. The ability to include security features like watermarks and microprinting ensures that your financial transactions remain secure. Lastly, Chase’s customer service team is readily available to assist with any questions or issues, ensuring a smooth and hassle-free experience. These benefits collectively make Chase a reliable choice for ordering checks.

Customizing Your Chase Checkbook: Options and Tips

When ordering a Chase checkbook, customization is key to ensuring that your checks meet your specific needs. Chase offers a variety of options to personalize your checkbook, from design choices to added security features. Understanding these options will help you make informed decisions and create a checkbook that aligns with your preferences.

Design Choices for Your Chase Checkbook

Chase provides an extensive selection of check designs, catering to both personal and business customers. For personal use, you can choose from elegant patterns, nature-inspired themes, or minimalist layouts. Business customers, on the other hand, can opt for professional designs that include space for a company logo or contact information. Here are some popular design categories:

- Classic Designs: Timeless and professional, ideal for formal transactions.

- Seasonal Themes: Festive and fun, perfect for gifting or special occasions.

- Custom Artwork: Unique designs tailored to your personal style or branding.

Adding Security Features to Your Checks

Security is a top priority when ordering checks, and Chase offers several features to protect your financial information. These include:

- Watermarks: Embedded designs visible when held up to light, making counterfeiting difficult.

- Microprinting: Tiny text that is hard to replicate, deterring fraudsters.

- Heat-Sensitive Ink: Changes color when rubbed, providing an additional layer of security.

Tips for Customizing Your Chase Checkbook

To make the most of your customization options, consider the following tips:

- Plan Ahead: Decide on your design and features before placing your order to avoid delays.

- Balance Style and Functionality: Choose a design that is visually appealing but also practical for your needs.

- Double-Check Details: Ensure that all personalized information, such as your name and address, is accurate.

By taking advantage of Chase’s customization options, you can create a checkbook that is both functional and reflective of your personality or business identity.

How Long Does It Take to Receive a Chase Checkbook?

Understanding the delivery timeline for your Chase checkbook is essential for planning your financial transactions. The time it takes to receive your checkbook depends on several factors, including the ordering method, shipping preferences, and your location. Generally, Chase aims to deliver checkbooks within 7 to 10 business days after placing the order. However, this timeframe may vary based on the specifics of your order.

If you choose expedited shipping, you can expect your checkbook to arrive sooner, often within 3 to 5 business days. This option is ideal if you need your checks urgently for upcoming payments or business operations. It’s important to note that expedited shipping may incur an additional fee, so be sure to factor this into your decision-making process. Additionally, orders placed online are typically processed faster than those made over the phone or in person, as the online system automates much of the workflow.

For customers residing in remote areas, delivery times may be slightly longer due to logistical challenges. To ensure timely delivery, always double-check your shipping address during the ordering process. Chase also provides tracking information for your order, allowing you to monitor its progress and plan accordingly. By understanding these factors, you can better anticipate when your Chase checkbook will arrive and avoid any disruptions to your financial activities.

Is It Safe to Order Checks Online With Chase?

Ordering checks online with Chase is a secure process, thanks to the bank’s robust security measures and partnerships with trusted check printing companies. Chase employs advanced encryption technologies to protect your personal and financial information during the ordering process. This ensures that your data remains confidential and inaccessible to unauthorized parties. Additionally, the bank’s online platform requires multi-factor authentication, adding an extra layer of security to your account.

Chase collaborates with reputable check printing companies that adhere to industry standards for security and quality. These companies use tamper-resistant paper and incorporate features like watermarks, microprinting, and heat-sensitive ink to prevent fraud. By ordering through Chase, you can rest assured that your checks are produced with the highest level of security in mind. Furthermore, Chase’s customer service team is available to address any concerns or issues you may encounter during the ordering process.

While online ordering is generally safe, it’s essential to take precautions on your end as well. Always ensure that you’re accessing Chase’s official website and avoid clicking on suspicious links or providing sensitive information on unsecured platforms. By combining Chase’s security measures with your own vigilance, you can confidently order a Chase checkbook online without compromising your financial safety.

Frequently Asked Questions About Ordering a Chase Checkbook

How Much Does It Cost to Order a Chase Checkbook?

The cost of ordering a Chase checkbook varies depending on the type of checks you choose and the quantity you order. Standard personal checks typically range from $15 to $30, while business checks may cost slightly more due to additional features. Expedited shipping and premium designs can also increase the total price. Chase provides a detailed breakdown of fees during the ordering process, allowing you to make an informed decision.

Can I Track My Chase Checkbook Order Online?

Yes, you can track your Chase checkbook order online. After placing your order, you’ll receive a confirmation email with a tracking number. Simply log in to your Chase online banking account and navigate to the “Order Status” section to monitor the progress of your shipment. This feature ensures transparency and allows you to plan accordingly.

What Should