Ordering new checks from Chase Bank can seem like a daunting task, especially if you're unfamiliar with the process or need them urgently. But don’t worry—whether you're reordering checks for your personal account or setting up checks for a new business account, Chase makes it simple and straightforward. In today’s fast-paced world, having access to reliable banking tools is essential, and checks remain an integral part of many financial transactions. Chase Bank, one of the largest financial institutions in the U.S., offers a seamless process to help you get your checks quickly and efficiently.

If you’re wondering how to navigate the process or whether there are any hidden fees, this guide will walk you through everything you need to know. From understanding the different types of checks available to exploring the various ways you can order them, we’ll cover all the bases. Plus, we’ll share tips to ensure you get the best value and avoid common pitfalls. Whether you’re a Chase customer or considering switching to Chase, this article will serve as your ultimate resource.

By the end of this guide, you’ll be equipped with the knowledge and confidence to order new checks Chase without any hassle. We’ll also address frequently asked questions and provide actionable insights to help you make informed decisions. So, let’s dive in and explore how you can streamline this essential banking task!

Read also:Skylar Lily Goddards Instagram A Deep Dive Into Her Life And Influence

Table of Contents

- Why Should You Order New Checks Chase?

- How to Order New Checks Chase Online?

- What Are the Different Types of Checks Available?

- How Much Does It Cost to Order New Checks Chase?

- What Customization Options Are Available for Your Checks?

- How Long Does It Take to Receive Your New Checks?

- What Are Alternative Ways to Order New Checks Chase?

- Frequently Asked Questions About Ordering New Checks Chase

Why Should You Order New Checks Chase?

There are several reasons why you might need to order new checks Chase. Whether it’s for personal use or business purposes, checks remain a vital tool for managing finances. Let’s explore some of the most common scenarios:

- Running Out of Checks: If you’re nearing the end of your current checkbook, it’s time to reorder. Running out of checks can disrupt your ability to pay bills or make payments on time.

- Updating Personal Information: If you’ve recently moved or changed your name, you’ll need new checks to reflect this updated information.

- Starting a New Account: When you open a new checking account with Chase, ordering checks is often the next step to make the account fully functional.

- Customizing Your Checks: Many people choose to reorder checks to incorporate custom designs, logos, or security features.

Chase Bank offers a user-friendly platform that simplifies the process of ordering checks. Whether you’re a first-time customer or a long-time account holder, the bank provides multiple options to suit your needs. Plus, Chase ensures that all checks meet industry-standard security features, giving you peace of mind when making payments.

How to Order New Checks Chase Online?

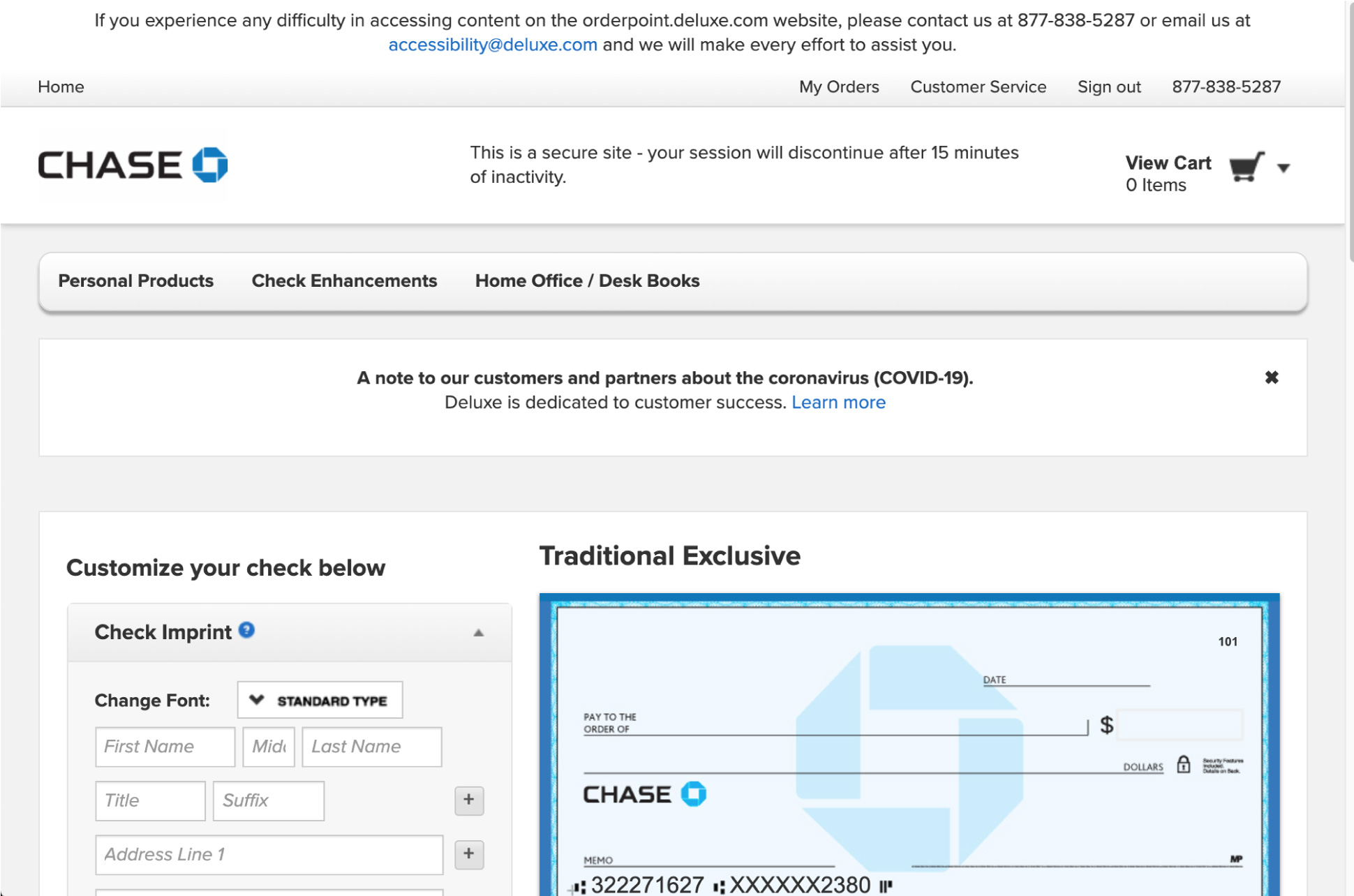

In today’s digital age, ordering checks online is the most convenient and efficient method. Chase Bank has streamlined this process to make it as easy as possible for its customers. Here’s a step-by-step guide to help you get started:

- Log in to Your Chase Account: Visit the official Chase Bank website and log in using your credentials. If you don’t have an online account, you’ll need to register first.

- Navigate to the Check Ordering Section: Once logged in, go to the “Services” tab and select “Order Checks.” This will take you to a dedicated page where you can customize and place your order.

- Choose Your Check Design: Chase offers a variety of check designs, including standard, premium, and custom options. You can also add features like security watermarks or duplicate checks for record-keeping.

- Review and Confirm Your Details: Before finalizing your order, double-check all the information, including your account number, address, and any customizations.

- Complete the Payment: Chase will charge a fee for your checks, which varies depending on the type and quantity you order. Once payment is confirmed, your order will be processed.

One of the advantages of ordering checks online is the ability to track your order status. Chase provides updates via email, so you’ll know exactly when to expect your new checks. Additionally, the online platform allows you to reorder checks quickly in the future, saving you time and effort.

Is It Safe to Order Checks Online?

Many people wonder whether ordering checks online is secure. The good news is that Chase employs advanced encryption and security measures to protect your personal information. When you order new checks Chase online, your data is safeguarded against unauthorized access. Moreover, the checks themselves come with built-in security features to prevent fraud and forgery.

What Are the Different Types of Checks Available?

When ordering new checks Chase, you’ll encounter a range of options tailored to different needs and preferences. Understanding these options will help you make an informed decision. Here’s a breakdown of the most common types of checks:

Read also:Erica Stoll Net Worth A Comprehensive Guide To Her Wealth And Achievements

1. Standard Checks

Standard checks are the most basic and cost-effective option. They come with a simple design and include essential details like your name, address, and account number. These checks are ideal for everyday use, such as paying bills or making small purchases.

2. Premium Checks

Premium checks offer a higher level of customization and quality. They often feature enhanced paper stock, vibrant colors, and intricate designs. If you’re looking to make a professional impression or want checks that stand out, this option is worth considering.

3. Business Checks

Business checks are specifically designed for companies and organizations. They include additional fields for things like invoice numbers and purchase orders, making them ideal for managing business expenses. Chase also offers specialized business check designs that align with your brand identity.

Can You Customize Your Checks?

Yes! Chase allows you to customize your checks with various features, such as adding your logo, choosing unique fonts, or selecting themed designs. These customization options are available for both personal and business checks, giving you the flexibility to create checks that suit your style.

How Much Does It Cost to Order New Checks Chase?

One of the most common questions people ask is, “How much does it cost to order new checks Chase?” The answer depends on several factors, including the type of checks you choose, the quantity, and any additional features you add. Here’s a general overview:

- Standard Checks: Typically range from $15 to $30 for a box of 200 checks.

- Premium Checks: Can cost between $30 and $60 for the same quantity.

- Business Checks: Prices vary widely, starting at $40 and going up to $100 or more, depending on the level of customization.

While the upfront cost might seem high, it’s important to consider the value you’re getting. Chase checks are printed on high-quality paper and include advanced security features like microprinting and watermarks. These features help protect you from fraud and ensure your checks are accepted without issue.

Are There Any Hidden Fees?

Chase is transparent about its pricing, so you won’t encounter any hidden fees when ordering checks. However, it’s always a good idea to review the total cost before finalizing your order. Additionally, some promotions or discounts may be available for first-time customers or during special events, so keep an eye out for those opportunities.

What Customization Options Are Available for Your Checks?

Customization is one of the standout features of ordering new checks Chase. Whether you’re looking to personalize your checks for personal use or align them with your business branding, Chase offers a variety of options to suit your needs. Let’s explore some of the most popular customization choices:

- Design Templates: Chase provides a wide selection of pre-designed templates, ranging from classic to modern styles. You can also upload your own design for a truly unique look.

- Color Options: Choose from a variety of colors to match your preferences or brand identity.

- Security Features: Add features like holograms, heat-sensitive ink, or duplicate copies for added protection and convenience.

- Font and Layout Adjustments: Customize the font style, size, and layout to ensure your checks reflect your personal or professional style.

Customizing your checks not only enhances their aesthetic appeal but also adds a layer of professionalism and security. For businesses, this can be particularly valuable in building trust with clients and partners.

How Long Does It Take to Receive Your New Checks?

Once you’ve placed your order, the next question on your mind is likely, “How long does it take to receive your new checks?” The delivery time depends on several factors, including the shipping method you choose and your location. Here’s what you can expect:

- Standard Shipping: Typically takes 7–10 business days. This is the most economical option and is suitable for non-urgent orders.

- Expedited Shipping: If you need your checks sooner, you can opt for expedited shipping, which usually takes 3–5 business days. However, this comes at an additional cost.

Chase provides tracking information for all orders, so you can monitor the status of your shipment. If you’re in a hurry, consider placing your order well in advance to avoid any last-minute stress.

What If Your Checks Don’t Arrive on Time?

In rare cases, delays may occur due to unforeseen circumstances like weather conditions or postal service issues. If your checks don’t arrive within the expected timeframe, contact Chase’s customer service team for assistance. They can help resolve the issue and ensure you receive your order promptly.

What Are Alternative Ways to Order New Checks Chase?

While ordering checks online is the most popular method, Chase also offers alternative ways to place your order. These options are particularly useful if you prefer a more hands-on approach or need assistance during the process. Here are some alternatives:

1. Ordering by Phone

If you’re not comfortable using the online platform, you can call Chase’s customer service team to place your order. A representative will guide you through the process and ensure all your details are accurate.

2. Visiting a Local Branch

For those who prefer face-to-face interactions, visiting a Chase branch is another viable option. A bank representative can help you select the right check type and customize your order on the spot.

Which Method Is Best for You?

The best method depends on your personal preferences and circumstances. If you value convenience and speed, ordering online is the way to go. However, if you need personalized assistance or have specific questions, visiting a branch or calling customer service might be more suitable.

Frequently Asked Questions About Ordering New Checks Chase

1. Can I Order Checks Without an Account?

No, you must have an active Chase checking account to order checks through the bank. If you don’t have an account, you’ll need to open one before proceeding.

2. What Should I Do If I Make a Mistake While Ordering?

If you notice an error after placing your order, contact Chase’s customer service team immediately. They may be able to correct the mistake before the checks are printed and shipped.

3. Are There Discounts for Bulk Orders?

Yes, Chase often offers discounts for larger quantities. If you frequently use checks, ordering in bulk can save you money in the long run.

Conclusion

Ordering new checks Chase is a straightforward process that offers flexibility, convenience, and customization options to meet your needs. Whether you choose to order online, by phone, or in person, Chase ensures a seamless experience with high-quality results. By understanding the available options and following the steps outlined in this guide, you can confidently place your order and receive checks that align with your personal or business requirements.

Remember, checks