Ordering checks from Chase is a straightforward process that can be completed online, over the phone, or even in person at a local branch. Whether you're a new account holder or simply running low on checks, understanding the steps involved ensures you can access this essential banking tool without any hassle. Chase Bank, one of the largest financial institutions in the United States, offers a variety of check designs and customization options to suit your personal or business needs. By following the correct procedure, you can have your checks delivered directly to your doorstep in no time.

Many customers wonder about the specifics of ordering checks from Chase, such as the cost, delivery time, and available customization options. Chase provides a user-friendly platform that allows you to order checks securely through your online account. This guide will walk you through every step, ensuring you have all the information you need to make the process smooth and efficient. Additionally, we'll address common concerns, like how to verify your account details and what to do if your checks don't arrive on time.

For those who prefer a more hands-on approach, Chase also allows customers to order checks via phone or in person. Whether you're managing personal finances or handling business transactions, having a reliable supply of checks is crucial. This article will provide a comprehensive overview of how to order checks from Chase, including tips for customization, frequently asked questions, and troubleshooting advice. By the end of this guide, you'll feel confident navigating the process and ensuring your banking needs are met.

Read also:Discover The Best Warm Destinations In The Usa For Your Next Getaway

Table of Contents

- What Are the Steps to Order Checks Online?

- How Can You Order Checks from Chase by Phone?

- Ordering Checks In-Person at a Chase Branch

- What Are the Customization Options for Your Checks?

- How to Track Your Check Order and Resolve Issues?

- What Are the Costs Involved in Ordering Checks?

- Understanding Delivery Times and Shipping Options

- Frequently Asked Questions About Ordering Checks from Chase

What Are the Steps to Order Checks Online?

Ordering checks online from Chase is one of the most convenient methods available. The process is simple and can be completed in just a few steps. To get started, you'll need to log in to your Chase Online account. If you haven't already set up online banking, you'll need to register for this service first. Once you're logged in, navigate to the "Order Checks" section, which is typically found under the "Services" or "Account Tools" tab.

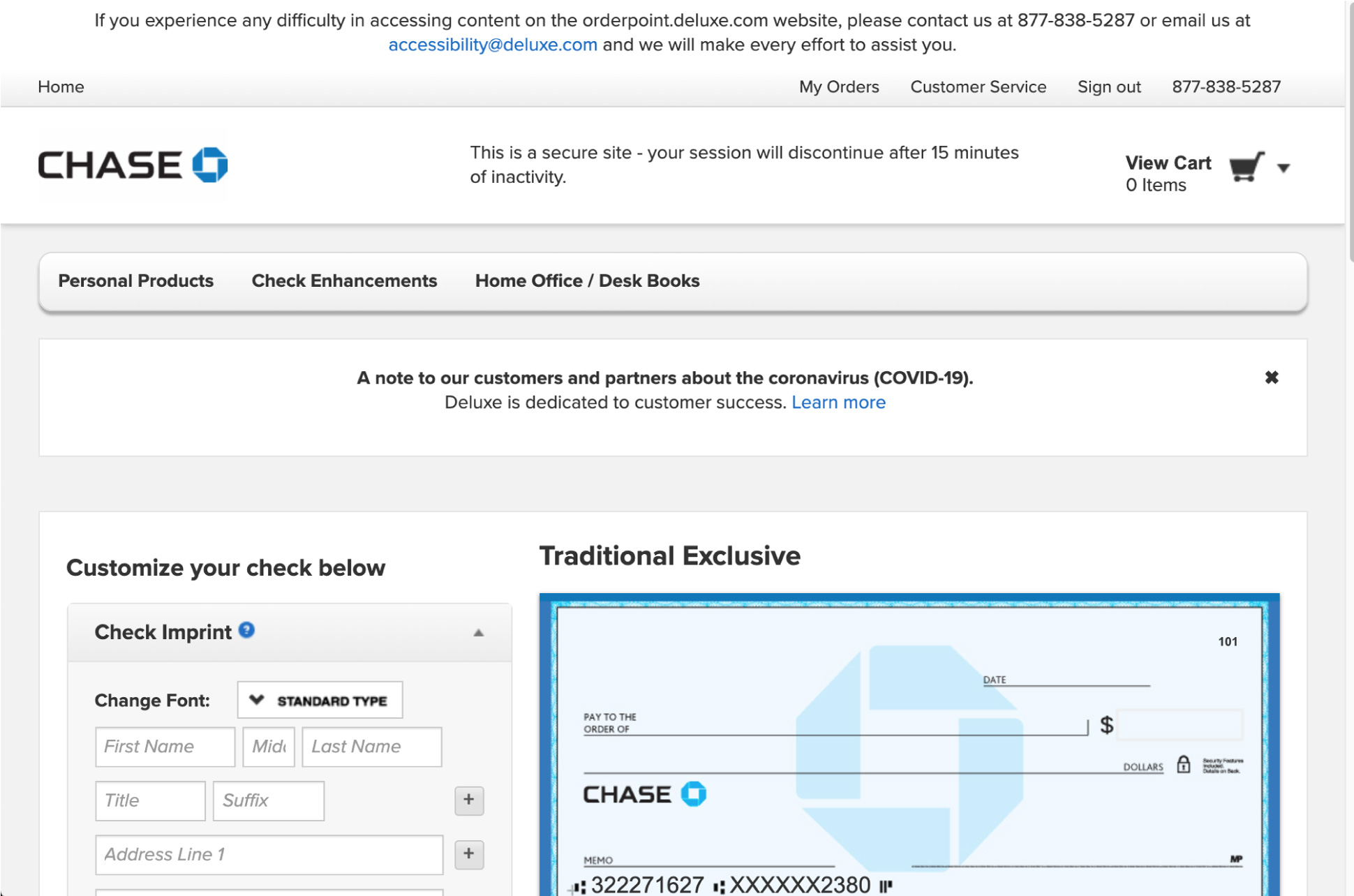

After selecting the "Order Checks" option, you'll be prompted to choose the type of checks you want to order. Chase offers a variety of check styles, including standard personal checks, business checks, and specialty designs. You can also select the quantity of checks you need, which usually comes in increments of 25 or 50. During this step, you'll have the opportunity to review your account information to ensure accuracy. This includes your name, address, and account number, which will be printed on the checks.

Once you've selected your check design and quantity, you'll proceed to the customization options. Here, you can add features like a company logo, a personalized message, or even a unique font style. After finalizing your choices, you'll be directed to the payment page. Chase typically charges a fee for check orders, which varies depending on the design and quantity. Payment is securely processed through your Chase account. After completing the transaction, you'll receive a confirmation email with an estimated delivery date. Your checks will be shipped directly to your address, usually within 7-10 business days.

How to Verify Your Account Details Before Ordering

Before finalizing your check order, it's crucial to verify your account details to avoid any errors. Start by double-checking your name and address, as these will be printed on every check. If there are any discrepancies, you can update your information directly through your Chase Online account. Additionally, ensure that your account number is correct, as this is essential for processing payments. Chase provides a preview of your checks during the ordering process, allowing you to review all details before submission.

Common Mistakes to Avoid When Ordering Checks Online

While ordering checks online is straightforward, there are a few common mistakes to watch out for. First, avoid rushing through the process without reviewing your choices. Selecting the wrong check style or quantity can lead to unnecessary expenses. Secondly, ensure that your shipping address is accurate to prevent delivery issues. Lastly, always review the total cost, including any additional fees for expedited shipping or customization, before confirming your order.

How Can You Order Checks from Chase by Phone?

If you prefer a more personal touch, ordering checks from Chase by phone is a great alternative. This method is particularly useful if you're unfamiliar with online banking or need assistance navigating the process. To order checks by phone, you'll need to contact Chase's customer service team. The phone number can be found on the back of your Chase debit card or on the official Chase website. Before making the call, ensure you have your account information handy, including your account number and routing number.

Read also:Papi Definition Exploring The Meaning Usage And Cultural Significance

When you call, a customer service representative will guide you through the check ordering process. They'll ask for details such as the type of checks you need, the quantity, and any customization preferences. The representative will also verify your account information to ensure accuracy. This step is crucial, as any mistakes could result in checks being printed with incorrect details. Once all the information is confirmed, the representative will process your order and provide an estimated delivery time.

One advantage of ordering checks by phone is the ability to ask questions in real-time. If you're unsure about the available check styles or customization options, the representative can provide detailed explanations and recommendations. Additionally, they can assist with any issues you might encounter, such as updating your account information or resolving payment concerns. After your order is placed, you'll receive a confirmation email or letter with the details of your purchase. Your checks will be shipped to your address, typically within the same timeframe as online orders.

What Information Do You Need to Have Ready for Phone Orders?

When ordering checks by phone, preparation is key to ensuring a smooth process. Start by gathering your account details, including your account number, routing number, and the name and address associated with your account. You'll also need to decide on the type of checks you want to order, such as personal or business checks, and the quantity required. If you're interested in customization options, have your preferences ready, such as font styles or additional features like a logo. This preparation will help the customer service representative process your order quickly and accurately.

Ordering Checks In-Person at a Chase Branch

For those who prefer face-to-face interaction, visiting a Chase branch to order checks is a reliable option. This method allows you to speak directly with a banking representative, who can guide you through the process and answer any questions you might have. To get started, locate your nearest Chase branch using the bank's official website or mobile app. Once you arrive, inform the representative that you'd like to order checks, and they'll assist you with the necessary steps.

The representative will ask for your account details, including your name, address, and account number, to ensure accuracy. They'll also help you choose the type of checks you need, whether it's personal checks, business checks, or specialty designs. During this process, you can explore customization options, such as adding a logo or selecting a unique font style. Once you've made your selections, the representative will process your order and provide an estimated delivery time. Payment is typically handled on-site, and you'll receive a confirmation receipt for your records.

Advantages of Ordering Checks In-Person

Ordering checks in person offers several advantages, particularly for those who value personalized service. One key benefit is the ability to receive immediate assistance from a banking representative. If you're unsure about the available check styles or customization options, the representative can provide detailed explanations and recommendations. Additionally, in-person ordering allows you to verify your account details in real-time, reducing the risk of errors. This method is also ideal for customers who prefer cash or check payments, as these options may not be available online or over the phone.

What Are the Customization Options for Your Checks?

When ordering checks from Chase, you have the opportunity to customize them to suit your personal or business needs. Chase offers a variety of customization options, allowing you to add a personal touch to your checks. For instance, you can choose from a range of check designs, including standard, premium, and specialty styles. These designs often feature unique patterns, colors, and themes, making it easy to find one that aligns with your preferences. Additionally, Chase provides options for adding a company logo, which is particularly useful for business checks.

Beyond design, you can also customize the content of your checks. This includes selecting a personalized message or font style, which can enhance the overall appearance. Chase also allows you to include additional features, such as security elements, to protect against fraud. These options not only make your checks more visually appealing but also increase their functionality. When placing your order, take the time to explore these customization features to ensure your checks meet your specific requirements.

How to Choose the Right Customization for Your Needs

Selecting the right customization options for your checks depends on your specific needs and preferences. Start by considering the purpose of the checks. For personal use, you might prioritize design and aesthetics, opting for a style that reflects your personality. For business checks, focus on professionalism and functionality, such as adding a company logo or security features. Additionally, think about the message you want to convey through your checks. A personalized message or unique font style can make a lasting impression on recipients.

How to Track Your Check Order and Resolve Issues?

Once you've placed your check order with Chase, it's important to track its progress to ensure timely delivery. Chase provides a tracking feature that allows you to monitor the status of your order online. To access this feature, log in to your Chase Online account and navigate to the "Order Status" section. Here, you'll find detailed information about your order, including the estimated delivery date and shipping status. This feature is particularly useful if you need your checks by a specific date, as it allows you to plan accordingly.

In the event that your checks don't arrive on time or there are issues with the order, Chase offers several options for resolving these problems. Start by contacting customer service through the phone number provided on the Chase website. A representative will assist you in tracking down your order and addressing any concerns. If the issue is related to incorrect account details or customization errors, the representative can guide you through the process of correcting these mistakes. Additionally, Chase may offer expedited shipping options for an additional fee to ensure you receive your checks as quickly as possible.

What to Do If Your Checks Don't Arrive on Time

If your checks don't arrive within the estimated delivery timeframe, it's important to take action promptly. Start by checking the tracking information provided by Chase to confirm the status of your order. If the tracking shows that the checks have been delivered but you haven't received them, contact customer service immediately. They can assist in locating the shipment or issuing a replacement order if necessary. Additionally, if the delay is due to an error on Chase's part, they may offer compensation or expedited shipping to resolve the issue.

What Are the Costs Involved in Ordering Checks?

Ordering checks from Chase involves certain costs, which vary depending on the type of checks and customization options you choose. Standard personal checks are typically the most affordable option, with prices starting at around $15 for a box of 25. Business checks and premium designs, on the other hand, tend to be more expensive due to their enhanced features and professional appearance. Additionally, customization options such as adding a logo or security features may incur additional fees. It's important to review the pricing details before placing your order to avoid unexpected expenses.

How to Save Money When Ordering Checks

While ordering checks from Chase is a convenient option, there are ways to save money on your purchase. One effective strategy is to take advantage of promotions or discounts offered by Chase. These deals are often available during specific times of the year, such as the holiday season, and can significantly reduce the cost of your order. Additionally, consider ordering checks in larger quantities, as this often results in a lower per-check price. Finally, compare the costs of ordering checks online versus in-person or by phone to ensure you're getting the best deal.

Understanding Delivery Times and Shipping Options