What is the compilation of information regarding claims for Payment Protection Program (PPP) loan guarantees? A comprehensive list of such claims can be vital for understanding the program's impact and potential future trends.

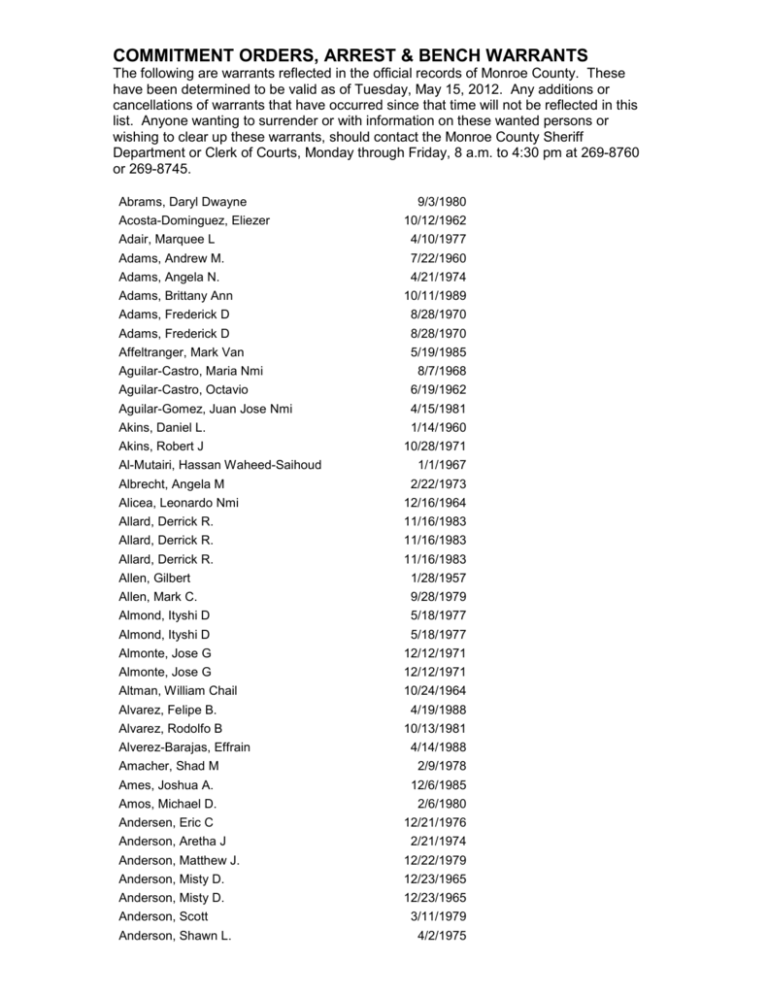

A list of PPP loan guarantees, often referred to as a "PPP loan warrant list," compiles data relating to small business loans secured under the Paycheck Protection Program. This data typically includes loan amounts, recipients' information (e.g., business name, address), and loan approval dates. Such lists might be assembled by government agencies, research institutions, or private entities. An example would be a dataset documenting all loans granted in a particular state during a specific period, with associated details.

Such a compilation of data is important for various reasons. It provides insights into the program's effectiveness in supporting businesses during economic downturns. Analyzing historical data from a PPP loan warrant list can inform policy decisions and potential future financial aid programs. The data may also be utilized for academic research or public policy analysis, enabling a more nuanced understanding of the program's long-term consequences. Further, it might be crucial for fraud detection and monitoring loan defaults.

Read also:Web S The Ultimate Guide To Understanding And Maximizing Your Online Presence

Analyzing this data can offer valuable insights into various aspects of the PPP loan program, such as geographic distribution of loan recipients, loan amount distribution, and trends over time. These insights can be used by policymakers, researchers, and business owners to better understand the program's impact and its implications for the economy and for future financial assistance programs.

PPP Loan Warrant List

Understanding the compiled data of Payment Protection Program (PPP) loan guarantees, or the PPP loan warrant list, is crucial for analyzing the program's impact and potential future trends.

- Data Compilation

- Loan Amounts

- Recipient Information

- Approval Dates

- Program Effectiveness

- Policy Implications

A PPP loan warrant list collates critical data points like loan amounts, recipients' identities, and approval dates. Analyzing this aggregated data offers insights into the program's reach and impact. For instance, examining loan amounts disbursed across different industries reveals the program's effectiveness in supporting specific sectors. Identifying frequent approval dates can illustrate fluctuations in program participation or responses to policy changes. The data also has policy implications; scrutinizing trends in recipients information, such as geographic location or business type, can inform future aid programs, potentially ensuring fairer distribution of funds. Ultimately, a PPP loan warrant list provides essential tools for assessing the program's impact on various facets of the economy.

1. Data Compilation

The compilation of data is fundamental to understanding the Paycheck Protection Program (PPP) loan program. A comprehensive dataset, often referred to as a PPP loan warrant list, involves assembling detailed information on loans issued under the program. This process encompasses gathering and organizing data related to loan amounts, recipients, approval dates, and other relevant factors. Accurate and systematic data compilation is essential for assessing the program's efficacy and potential future impacts.

- Loan Amount Distribution

Analyzing the distribution of loan amounts across various sectors and businesses provides insights into the program's overall effectiveness. Understanding which industries received the largest loans, or whether smaller businesses were proportionally served, is crucial for evaluating the program's success in supporting businesses of differing sizes and types. This data could, for instance, highlight areas needing further assistance. A uniform distribution of funding would imply better overall support.

- Geographic Distribution of Recipients

Examining the geographic location of PPP loan recipients offers insights into the program's regional impact. Identifying disparities in loan disbursement across states or regions reveals potential inequities in program access or delivery. Such an analysis could identify underserved areas where future programs might need to concentrate their efforts.

Read also:

- Matilda Ledger A Rising Star In The Entertainment World

- Loan Approval Timelines

Tracking loan approval times can provide indicators of program efficiency and potential bottlenecks. Variations in processing speeds can signal areas needing improvement in administrative procedures. Analysis of delays, for instance, can point to administrative inefficiencies or issues in regulatory compliance.

- Correlation with Business Outcomes

Exploring connections between PPP loan receipt and subsequent business outcomes, such as employment retention or business survival, is critical for evaluating the program's effectiveness in achieving its intended goals. Data could reveal which businesses were successful in using the funds to weather the economic disruption. This analysis will indicate how effective the program was in meeting its objective of preserving jobs during the economic crisis. It provides an objective way to evaluate the impact of the program.

The meticulous compilation and systematic analysis of data contained within a PPP loan warrant list, focusing on loan amount, geographic distribution, approval times, and correlations to business outcomes, provide valuable insights into the program's impacts. This structured approach helps in forming a comprehensive understanding of the program's achievements and potential areas for improvement. Ultimately, a well-curated compilation of data, carefully reviewed and analyzed, will contribute significantly to the informed assessment of such large-scale economic programs.

2. Loan Amounts

Loan amounts represent a crucial element within a Payment Protection Program (PPP) loan warrant list. Analysis of these figures provides significant insights into the program's impact and potential areas for improvement. Understanding the distribution and characteristics of loan amounts facilitates a more nuanced understanding of the program's effectiveness in supporting small businesses.

- Distribution Analysis

Examining the range and frequency of loan amounts reveals patterns in how the program allocated funds. High concentrations of smaller loans might suggest the program effectively reached smaller businesses, while a predominance of larger loans could indicate preferential treatment for certain types of businesses. A skewed distribution could point to unintended consequences or areas needing adjustments.

- Correlation with Business Size

Investigating the relationship between loan amounts and business size is critical. A correlation might indicate whether the program successfully targeted smaller businesses, or if larger businesses were disproportionately favored. This analysis helps assess the equitable allocation of resources. Discrepancies can suggest areas requiring policy changes to ensure fairer access to aid.

- Impact on Economic Sectors

Evaluating loan amounts allocated to various economic sectors reveals the program's impact on specific industries. This analysis can identify sectors that benefited most, highlighting the effectiveness of the program in supporting particular businesses or industries. Conversely, sectors receiving smaller amounts might highlight areas that require additional support.

- Trends over Time

Tracking changes in loan amounts over time provides insights into how the program's approach evolved. Fluctuations in loan amounts might reflect policy adjustments, economic conditions, or changing program priorities. Examining historical trends offers insights into how the allocation of funds adapted in response to evolving conditions.

In summary, the analysis of loan amounts within a PPP loan warrant list allows a comprehensive assessment of the program's performance. Considering the distribution, correlation with business size, impact on economic sectors, and trends over time enriches the understanding of the program's efficacy and identifies potential improvements for future initiatives.

3. Recipient Information

Recipient information within a PPP loan warrant list is fundamental. This data, encompassing details about entities receiving loans, is essential for understanding the program's reach and impact. Analysis of this information enables a comprehensive evaluation of program effectiveness and equitable distribution.

- Business Type and Industry

Identifying the types of businesses receiving PPP loans reveals the program's impact across various sectors. Analysis might highlight whether certain industries or business types disproportionately benefited from the program. For example, if a significant portion of loans went to restaurants, it suggests a focused effort to support that sector. Alternatively, a lack of representation from specific sectors could signal gaps in the program's reach or effectiveness.

- Geographic Location

Examining the geographic distribution of loan recipients provides insights into regional disparities or concentrated program activity. High concentrations in specific areas could indicate localized economic needs or program implementation strategies. Conversely, a lack of recipients in certain regions could highlight areas needing additional focus for future financial support initiatives.

- Size of Business (Employees/Revenue)

Analyzing the size of recipient businesses (measured by employee count or revenue) offers insights into the program's impact on diverse-sized enterprises. A high concentration of loans for smaller businesses might signify that the program effectively targeted vulnerable entities. Conversely, a pattern of larger recipients could suggest disparities in resource allocation.

- Loan Default Rates (with cautions)

Examining default rates (with careful consideration for potential biases and external factors) linked to recipient information can highlight potential weaknesses within the program. A correlation between specific business types or geographic areas and higher default rates may point to factors needing attention. Such analysis necessitates considering economic fluctuations and other external influences. However, identifying these potential issues is vital for informed future policy decisions.

Recipient information, when integrated into a comprehensive analysis of a PPP loan warrant list, provides a detailed portrait of the program's impacts. Identifying trends in business type, location, size, and potential default rates helps in understanding program strengths and weaknesses. The data's potential for future analysis and informed policy decisions surrounding similar financial assistance programs is significant.

4. Approval Dates

Approval dates, recorded in a PPP loan warrant list, provide crucial temporal context. Understanding the timing of loan approvals offers valuable insights into the program's operations, effectiveness, and potential implications. Analyzing these dates allows for the identification of trends, patterns, and potential bottlenecks in the loan processing stages.

- Temporal Trends in Approvals

Examining the distribution of approval dates reveals potential trends in the program's activity. Consistent peaks or valleys in approval activity might correspond to specific events or policy changes. For example, a sudden spike in approvals immediately following a specific announcement could suggest a heightened demand or a response to a particular economic concern. Identifying these trends provides insight into the dynamics of the program and its responsiveness to external factors.

- Processing Time Analysis

Calculating the average time taken to process loan applications offers insights into the program's efficiency. Significant delays could indicate bottlenecks in the system or administrative challenges. Identifying these processing time delays helps understand the program's operational capacity and potential areas for improvement. Faster processing times might indicate a well-oiled administrative machine or efficient implementation of changes.

- Correlation with Economic Conditions

Correlating approval dates with relevant economic indicators (e.g., unemployment rates, GDP growth) can help determine whether the program's responsiveness aligned with the economic climate. A lag between economic downturns and increased approvals could indicate that the program's response wasn't immediate. A more immediate response might suggest a more efficient mechanism for responding to economic shocks.

- Policy Impact Analysis

Comparing approval dates with any modifications or adjustments to program guidelines can provide insight into the impact of policy changes. An immediate drop in approvals following a policy shift might indicate that the change had an impact on the program's operations. By analyzing the correlation of approval dates with such policy modifications, a clearer understanding of the program's implementation and responses to policy changes is revealed.

In conclusion, approval dates, integrated with the other data within a PPP loan warrant list, offer a comprehensive picture of the program's temporal dynamics. Analyzing these dates allows for a deeper comprehension of the program's operations, its responsiveness to external factors, and the possible impact of policy changes. By using these insights, a clearer picture of the program's impact and efficacy in addressing economic challenges can be constructed.

5. Program Effectiveness

Assessing the effectiveness of the Paycheck Protection Program (PPP) relies heavily on data analysis. A comprehensive list of PPP loan guarantees, often referred to as a PPP loan warrant list, serves as a crucial source for evaluating the program's success. This analysis examines key aspects of program effectiveness, using data from the warrant list to identify patterns and trends.

- Impact on Employment Retention

Analyzing the relationship between loan recipients and subsequent employment figures reveals the program's impact on job retention. A correlation between PPP loan receipt and stable employment levels suggests the program's effectiveness in supporting businesses and preventing layoffs. Conversely, a lack of such correlation could point to areas needing improvement in program design or implementation. Detailed data in the warrant list, linking loans to specific businesses and employment numbers, is vital for this analysis.

- Influence on Business Survival

Examining business survival rates among PPP loan recipients versus those who did not receive loans provides another perspective on the program's effectiveness. If a significantly higher percentage of loan recipients remain in business compared to a control group, it suggests the program facilitated business survival during challenging economic periods. Conversely, significant business closures among recipients could indicate areas for program refinement. This evaluation requires data on business closures and relevant information from the warrant list, linking loans to business outcomes.

- Geographic Distribution of Impacts

An analysis of the geographic distribution of PPP loan recipients, linked to relevant economic indicators, clarifies regional variations in the program's effectiveness. If certain regions exhibit greater employment retention or business survival among PPP loan recipients, it points to either localized economic needs being effectively addressed or efficient program implementation in specific locations. A lack of impact in particular areas could indicate geographical disparities in access or effectiveness. This hinges on a thorough geographical breakdown from the warrant list.

- Evaluation of Loan Amount and Business Performance

The relationship between loan amounts and business performance (such as increased revenue or growth) can illuminate the program's impact on different-sized businesses. Analyzing if larger loans correlate with greater improvements could indicate a positive program response to larger businesses' needs. Conversely, if there's no significant correlation, it might signal a need to tailor the program's approach based on business size or other factors. This hinges on the proper parsing of data linking loan size and business financial metrics from the warrant list.

By carefully examining the data within a PPP loan warrant list, a comprehensive and detailed picture of the program's effectiveness can be constructed. The insights gleaned from these analyses provide valuable information for shaping future economic relief strategies.

6. Policy Implications

A comprehensive analysis of PPP loan warrant lists yields significant policy implications. The data contained within these lists, regarding loan amounts, recipients, and approval dates, provides a wealth of information for evaluating program effectiveness and identifying areas needing adjustments. Historical data allows for assessment of the program's impact on specific sectors, regions, and business sizes. This in turn guides potential adjustments to future policies related to economic stimulus, small business support, and disaster relief. For example, patterns of loan defaults or trends in business closures among certain recipients can indicate vulnerabilities in the program's design or implementation, prompting policy changes aimed at mitigating risks.

The practical significance of understanding policy implications derived from PPP loan warrant lists is substantial. Identifying regional disparities in loan distribution reveals potential inequities in program access, prompting policymakers to consider targeted interventions or adjustments in eligibility criteria. The analysis might further highlight trends in loan applications and approval times, suggesting potential bottlenecks in the program's processing mechanisms. Moreover, correlations between specific business types and loan default rates can illuminate underlying vulnerabilities in certain sectors, motivating targeted support measures or further research to understand the factors driving these trends. Furthermore, analyzing changes in loan amounts across various economic cycles can influence future stimulus designs and allocation strategies.

In conclusion, insights gleaned from PPP loan warrant lists carry substantial policy implications. Understanding patterns in loan disbursement, recipient characteristics, and outcomes empowers policymakers to design more effective and equitable economic stimulus measures. By identifying potential weaknesses in program design and implementation, and understanding the varied impacts across diverse business sectors and regions, the lessons learned from analyzing these data can lead to better-tailored and more impactful economic policies for future crises or challenges.

Frequently Asked Questions about PPP Loan Warrant Lists

This section addresses common inquiries regarding Payment Protection Program (PPP) loan warrant lists. These lists compile data on PPP loans, providing insights into the program's impacts and offering valuable information for analysis. Answers are based on publicly available data and established economic principles.

Question 1: What is a PPP Loan Warrant List, and what information does it contain?

A PPP loan warrant list is a compilation of data about loans issued under the Paycheck Protection Program. Information typically includes loan amounts, recipient business details (name, address), approval dates, and potentially other pertinent data points. The purpose is to compile a comprehensive dataset for analysis of program effectiveness and economic impacts.

Question 2: What is the purpose of analyzing a PPP Loan Warrant List?

Analyzing PPP loan warrant lists serves various purposes. It enables researchers and policymakers to assess program effectiveness in achieving its intended goals, such as preserving jobs and supporting businesses during economic downturns. Analysis of the data may identify trends and patterns, including geographic distribution of loan recipients, loan amounts disbursed across industries, and correlations between loan receipt and subsequent business performance metrics. The information can support the development of informed economic policies and future aid programs.

Question 3: How can a PPP Loan Warrant List help assess the program's impact on employment?

A PPP loan warrant list can assist in understanding the program's impact on employment by correlating loan receipt with employment data. If a significant proportion of businesses receiving PPP loans demonstrate stable or improved employment figures compared to a control group, this indicates a positive impact on employment retention. Conversely, a lack of correlation suggests the program may not have achieved its goals in specific contexts or sectors.

Question 4: What are some limitations in using a PPP Loan Warrant List for analysis?

Limitations in using a PPP loan warrant list for analysis include potential data inaccuracies, the need for additional context from external sources to fully understand the data, and the inability to establish definitive causal relationships between loan receipt and business outcomes. The presence of external factors (economic conditions, industry-specific dynamics) may confound analysis, requiring researchers to use appropriate methodologies to mitigate these effects and interpret findings cautiously.

Question 5: How can businesses use a PPP Loan Warrant List?

Businesses can use a PPP loan warrant list to analyze industry trends, identify areas where the program was effective, and understand if similar loans might be beneficial during future economic downturns. It could also inform business decisions related to strategic planning and financial resilience.

Understanding the potential insights and limitations of PPP loan warrant lists provides a more informed perspective on the Paycheck Protection Program's effectiveness and future implications.

This concludes the FAQ section. The next section will explore specific applications of PPP loan warrant list analysis.

Conclusion

Examination of Payment Protection Program (PPP) loan warrant lists reveals a complex picture of the program's impact. These lists, encompassing data on loan amounts, recipient information, and approval dates, offer a granular view of loan disbursement patterns. Analysis of this data highlights the program's reach across various industries and regions, revealing both successes and potential weaknesses. Understanding the distribution of loan amounts, the characteristics of recipients, and the timing of approvals provides valuable insights into program effectiveness in preserving employment and supporting businesses during economic hardship. Further, by identifying potential disparities and trends in loan defaults or business closures, the data informs crucial discussions about policy adjustments for future economic relief initiatives.

The insights derived from analyzing PPP loan warrant lists hold significant implications for policymakers, researchers, and businesses alike. Accurate interpretation of the data, coupled with consideration of external economic factors, can lead to a more nuanced understanding of the program's long-term impact. Careful examination of these lists allows for identification of both effective strategies and potential areas needing improvement for future economic safety nets. Continued analysis of this data remains crucial for the evolution of robust and equitable economic recovery programs.