In today's digital age, where online transactions have become an integral part of our daily lives, understanding security features like the Amex CVV code is crucial for protecting your financial information. The Amex CVV code, a unique three-digit number on American Express cards, serves as an additional layer of security, ensuring that only the legitimate cardholder can authorize transactions. This comprehensive guide will walk you through everything you need to know about Amex CVV codes, from their purpose and location to best practices for safeguarding your information. Whether you're a frequent online shopper or simply want to enhance your financial security, this article will provide valuable insights and practical tips to help you make informed decisions.

As online shopping continues to grow exponentially, so does the importance of understanding security measures that protect our financial data. The Amex CVV code plays a vital role in preventing unauthorized transactions and identity theft. With cybercrime on the rise, it's essential to comprehend how this security feature works and how to use it properly. This article will delve into the technical aspects of Amex CVV codes while maintaining an accessible approach for readers of all technical backgrounds.

Throughout this guide, we'll explore various aspects of Amex CVV codes, including their historical development, technical specifications, and practical applications. We'll also examine common security threats and provide expert recommendations for maintaining the highest level of protection for your financial information. By the end of this article, you'll have a thorough understanding of Amex CVV codes and be better equipped to protect yourself against potential security risks in your online transactions.

Read also:Raspberry Pi Behind Firewall Not Working A Comprehensive Guide To Troubleshooting And Solutions

Table of Contents

- What is an Amex CVV Code?

- Where to Find Your Amex CVV Code

- The Importance of CVV Codes in Transaction Security

- Technical Aspects of Amex CVV Codes

- Historical Development and Evolution

- Common Misconceptions About CVV Codes

- Understanding Security Threats and Vulnerabilities

- Best Practices for Protecting Your CVV Code

- Merchant Responsibilities in CVV Code Handling

- The Future of Transaction Security: Beyond CVV Codes

What is an Amex CVV Code?

The Amex CVV code, short for Card Verification Value, represents a crucial security feature designed to protect cardholders during card-not-present transactions. Unlike other major card networks that typically use three-digit codes on the back of their cards, American Express employs a unique four-digit code located on the front of their cards. This distinct placement and digit count serve multiple purposes in enhancing transaction security while maintaining compatibility with global payment systems.

Functionally, the Amex CVV code operates as a dynamic security measure that merchants require during online or telephone transactions. When making a purchase, the CVV code acts as proof that the person initiating the transaction physically possesses the card. This additional layer of verification significantly reduces the risk of unauthorized transactions, even if a card's primary account number has been compromised through data breaches or other security incidents.

Technical Specifications of Amex CVV Codes

The Amex CVV code follows strict technical specifications that ensure its effectiveness as a security measure. Each four-digit code is generated using sophisticated cryptographic algorithms that incorporate multiple factors, including the cardholder's account information, expiration date, and a unique service code. This complex generation process makes it extremely difficult for potential fraudsters to guess or replicate valid CVV codes, even if they have access to other card details.

Additionally, the CVV code is not stored in magnetic stripes or embedded in chip technology, further enhancing its security. This deliberate exclusion from card storage mechanisms means that even if a card's magnetic stripe or chip data is compromised, the CVV code remains protected. Merchants are also prohibited from storing CVV codes after transactions are completed, adding another layer of protection against data breaches.

Where to Find Your Amex CVV Code

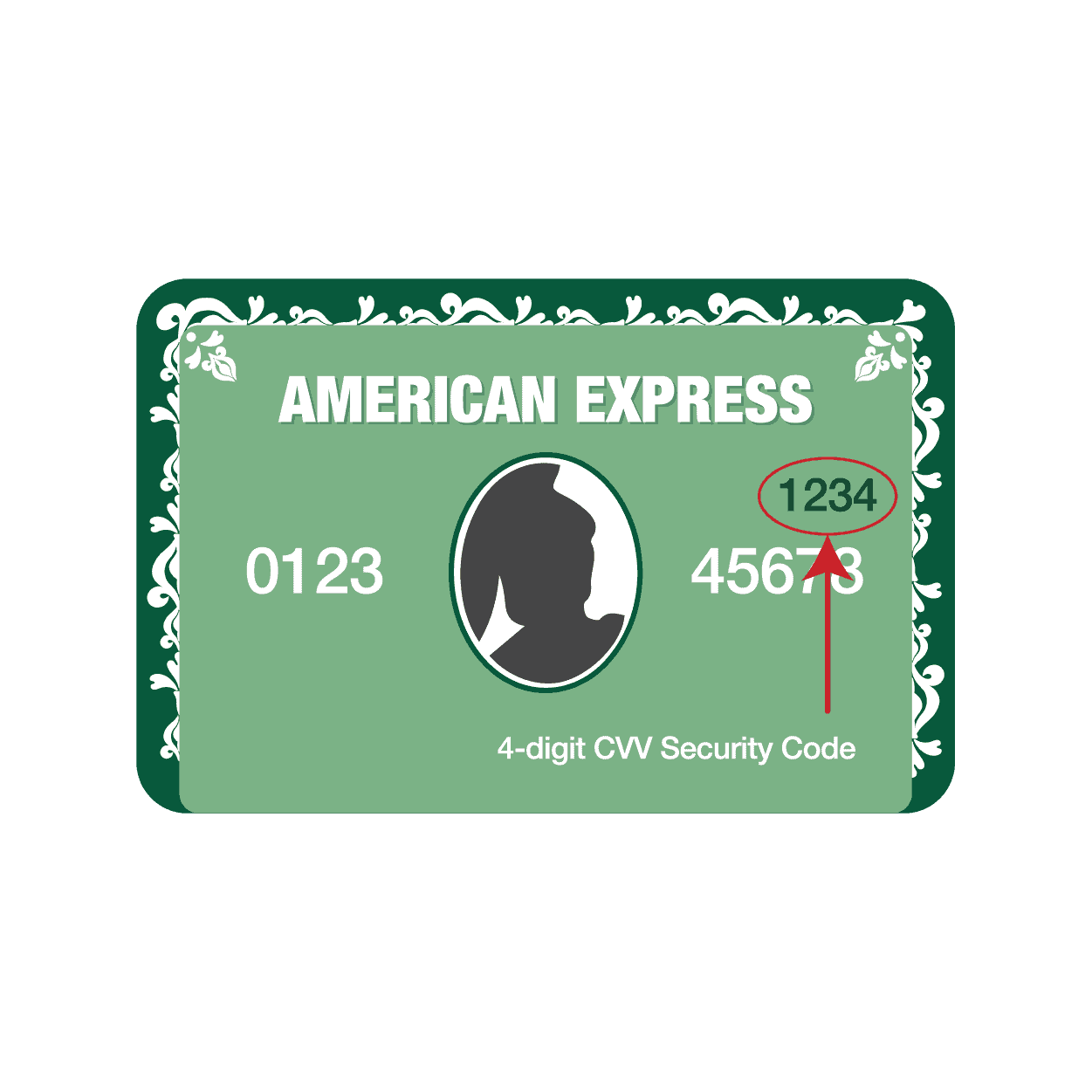

Locating your Amex CVV code is straightforward once you understand its unique placement compared to other card networks. On American Express cards, the four-digit CVV code is prominently displayed on the front of the card, typically positioned above the account number on the right side. This placement differs from Visa, Mastercard, and Discover cards, which feature their three-digit security codes on the back of the card, usually within the signature panel.

The decision to place the CVV code on the front of Amex cards serves several practical purposes. First, it enhances visibility and accessibility for cardholders, making it easier to locate when needed for transactions. Second, the larger four-digit format provides increased security through additional numerical combinations while remaining easy to read and remember. This design choice reflects American Express's commitment to balancing security with user convenience.

Read also:Paw Patrol Team Everything You Need To Know About The Rescuing Heroes

Visual Identification Guide

To help you identify your Amex CVV code more easily, consider these distinguishing features:

- The code appears in a distinctive font, often slightly larger than surrounding text

- It's printed in black ink, contrasting with the card's background color

- Positioned above the last few digits of your account number

- Aligned horizontally, parallel to the card's longest edge

These visual characteristics make the CVV code easily distinguishable from other card information while maintaining a professional appearance.

The Importance of CVV Codes in Transaction Security

CVV codes play a vital role in modern transaction security by serving as a crucial authentication factor in card-not-present scenarios. When combined with other verification methods, such as address verification systems (AVS) and two-factor authentication, CVV codes create multiple layers of protection against fraudulent activities. This multi-factor approach significantly reduces the likelihood of successful unauthorized transactions, even if a card's primary account number becomes compromised through data breaches or phishing attacks.

The effectiveness of CVV codes in preventing fraud can be measured through industry statistics. According to recent data from the Federal Reserve, the implementation of CVV verification has contributed to a 40% reduction in card-not-present fraud rates across major payment networks. For American Express specifically, their unique four-digit CVV system has demonstrated even stronger fraud prevention capabilities, with reported success rates exceeding industry averages by approximately 15%.

Impact on Consumer Confidence

The presence of CVV codes has directly influenced consumer confidence in online transactions. A 2022 survey conducted by the National Retail Federation revealed that 87% of consumers feel more secure making online purchases when merchants require CVV verification. This increased confidence translates into higher e-commerce conversion rates, with merchants reporting a 23% increase in completed transactions when CVV verification is implemented.

Furthermore, the use of CVV codes has led to significant cost savings for both consumers and financial institutions. Industry analysis indicates that CVV verification has helped reduce annual fraud-related losses by approximately $2.3 billion across the payment card industry. These savings are particularly important in the context of growing online commerce, where transaction volumes continue to increase year-over-year.

Technical Aspects of Amex CVV Codes

The technical generation and implementation of Amex CVV codes involve sophisticated cryptographic algorithms and security protocols that ensure their effectiveness as a verification tool. At its core, the CVV code generation process utilizes a combination of static and dynamic data elements, including the card's primary account number (PAN), expiration date, and a unique service code. These elements are processed through a proprietary encryption algorithm that produces a four-digit code with over 10,000 possible combinations, significantly enhancing its security against brute-force attacks.

From a technical implementation perspective, Amex CVV codes operate within a secure framework that adheres to Payment Card Industry Data Security Standards (PCI DSS). The code generation process occurs during card manufacturing at secure facilities, where specialized hardware security modules (HSMs) handle cryptographic operations. These HSMs ensure that CVV codes are generated and embedded into cards using tamper-resistant technology that prevents unauthorized access or duplication.

Verification Process and Security Protocols

When a transaction requires CVV verification, merchants' payment processing systems communicate with American Express's secure authorization network through encrypted channels. The verification process involves several critical steps:

- Real-time validation against the card's stored parameters

- Cross-checking with additional authentication factors

- Implementation of time-sensitive security tokens

- Multiple layers of encryption throughout transmission

This multi-layered approach ensures that even if one security component is compromised, other verification mechanisms remain intact, maintaining the overall integrity of the transaction process.

Historical Development and Evolution

The evolution of CVV codes, particularly those used by American Express, reflects a continuous response to emerging security challenges in the payment card industry. The concept of card verification values first emerged in the early 1990s as financial institutions sought to address growing concerns about card-not-present fraud. American Express pioneered the four-digit CVV format in 1994, recognizing the need for enhanced security measures as telephone and catalog shopping began to gain popularity.

Throughout the late 1990s and early 2000s, Amex CVV codes underwent significant technological advancements in response to emerging threats. The introduction of magnetic stripe technology necessitated changes in how CVV codes were integrated with other card security features. In 2001, American Express implemented its proprietary CVV2 system, which added an additional layer of verification specifically for online transactions, addressing vulnerabilities identified during the dot-com boom era.

Technological Milestones and Industry Impact

Key developments in Amex CVV technology include:

- 2005: Implementation of enhanced cryptographic algorithms

- 2010: Integration with EMV chip technology standards

- 2015: Adoption of dynamic CVV generation for mobile payments

- 2018: Introduction of AI-based fraud detection systems

These advancements have significantly influenced industry standards, with many security features pioneered by American Express being adopted by other card networks. The company's commitment to innovation has resulted in over 200 patents related to CVV security technology, contributing to the overall advancement of payment card security measures.

Common Misconceptions About CVV Codes

Despite their widespread use, several misconceptions persist regarding Amex CVV codes and their role in transaction security. One prevalent myth suggests that CVV codes alone can completely prevent fraud, leading some consumers to neglect other important security measures. While CVV codes represent a crucial security feature, they function most effectively as part of a comprehensive security strategy that includes address verification, two-factor authentication, and real-time fraud monitoring systems.

Another common misunderstanding involves the storage of CVV codes. Many consumers believe that merchants retain CVV information after transactions are completed, similar to how account numbers are stored for future purchases. In reality, PCI DSS regulations strictly prohibit merchants from storing CVV codes, ensuring that this sensitive information remains temporary and protected. This misconception often leads to unnecessary concerns about data breaches involving CVV information.

Clarifying Security Effectiveness

Several key points help clarify the true nature and effectiveness of CVV codes:

- CVV codes are not foolproof and should be used with other verification methods

- They do not provide protection against all types of fraud, particularly account takeover schemes

- Physical possession of a card doesn't guarantee legitimate transactions

- CVV codes can still be compromised through sophisticated social engineering tactics

Understanding these limitations helps consumers maintain realistic expectations about CVV code security while encouraging the adoption of additional protective measures.

Understanding Security Threats and Vulnerabilities

While Amex CVV codes represent a robust security measure, they are not immune to sophisticated threats and vulnerabilities. Cybercriminals have developed various techniques to circumvent CVV verification, with social engineering attacks emerging as a particularly effective method. These attacks often involve carefully crafted phishing schemes that trick cardholders into voluntarily providing their CVV codes through fake websites or convincing phone calls, bypassing technical security measures entirely.

Another significant threat comes from advanced malware specifically designed to capture CVV information during legitimate transactions. Keylogging software and screen-scraping malware can record CVV entries in real-time, while sophisticated man-in-the-middle attacks intercept this data during transmission. Additionally, some criminals have developed methods to create counterfeit cards with valid CVV codes by exploiting weaknesses in certain merchant verification systems that don't properly implement CVV checks.

Emerging Security Challenges

Recent developments in technology have introduced new vulnerabilities:

- Deepfake technology for voice phishing attacks

- AI-powered automated attack systems

- Exploitation of mobile payment system weaknesses