Have you ever wondered how long a credit check impacts your credit score? Whether you're applying for a loan, a credit card, or even renting an apartment, lenders often perform credit checks to evaluate your financial reliability. While these checks are a standard part of the lending process, they can have an impact on your credit score. This guide will explore the nuances of credit checks, their duration, and how they influence your credit score over time.

Understanding the mechanics of credit checks is essential for anyone navigating the financial world. A credit check, also known as a credit inquiry, occurs when a lender or financial institution reviews your credit report to assess your creditworthiness. There are two types of inquiries: soft and hard. While soft inquiries, like checking your own credit score, don't affect your credit score, hard inquiries can leave a temporary mark. The good news is that this impact is usually short-lived, but how long does it last? Let’s dive deeper into the details.

In this article, we’ll cover everything you need to know about how long a credit check affects your score. From the types of inquiries to their duration and ways to minimize their impact, this guide is designed to empower you with actionable insights. By the end, you’ll have a clear understanding of how credit checks work and how you can maintain a healthy credit score while managing inquiries effectively.

Read also:Coolgames The Ultimate Guide To Gaming Excellence

Table of Contents

- What Is a Credit Check and Why Does It Matter?

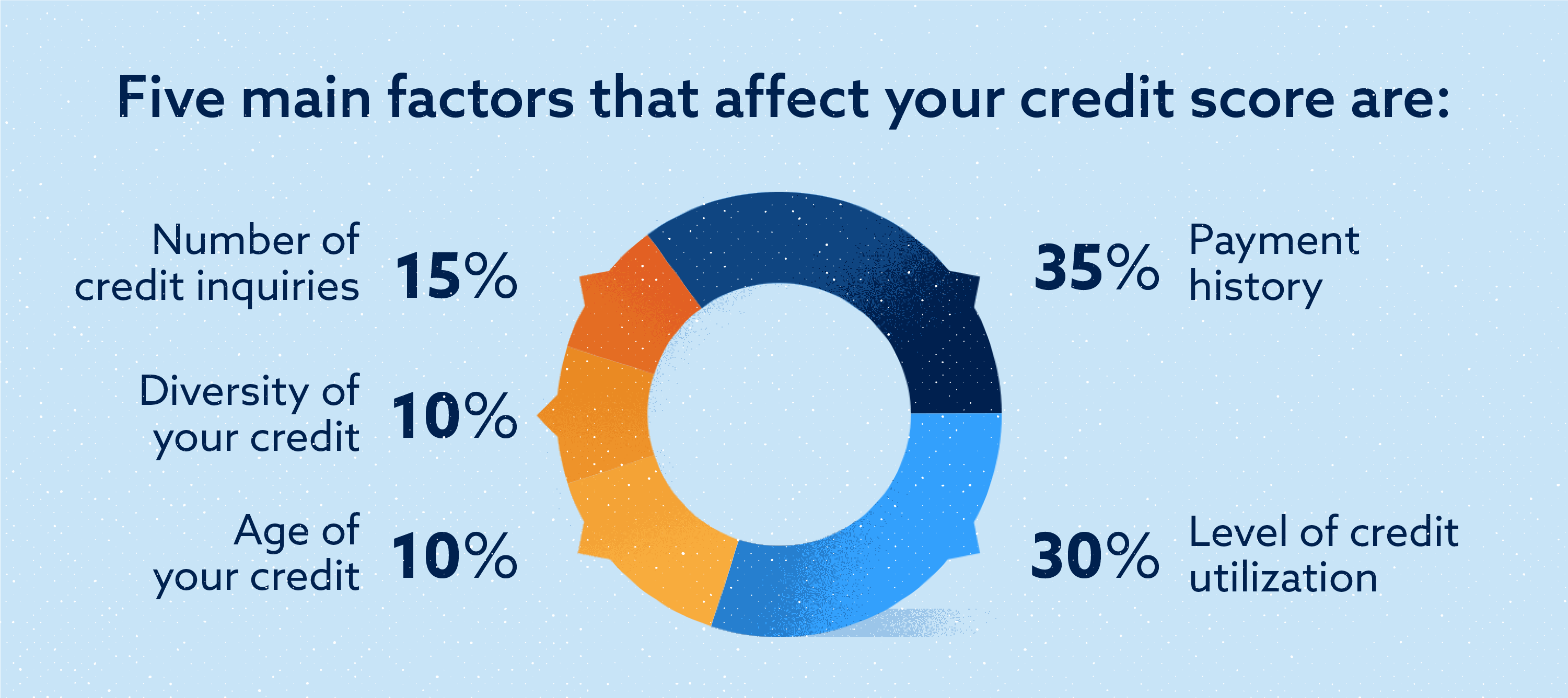

- Types of Credit Inquiries: Which Ones Affect Your Score?

- How Long Does a Credit Check Affect Your Score?

- Can Multiple Credit Inquiries Hurt Your Score?

- How to Minimize the Impact of Credit Inquiries?

- Does the Impact of Credit Checks Vary by Credit Score?

- How to Monitor Your Credit Score After a Credit Check?

- Frequently Asked Questions About Credit Checks

What Is a Credit Check and Why Does It Matter?

A credit check, also referred to as a credit inquiry, is the process by which lenders, landlords, or employers review your credit report to evaluate your financial behavior. This report includes details about your credit accounts, payment history, outstanding debts, and any negative marks like defaults or bankruptcies. Credit checks are a critical tool for lenders to determine whether you’re a trustworthy borrower and what interest rates you might qualify for.

Why does this matter? Simply put, your credit score is a reflection of your financial health. A good credit score can open doors to favorable loan terms, lower interest rates, and better credit card offers. Conversely, a poor credit score can make borrowing more expensive or even lead to loan denials. Credit checks play a pivotal role in shaping this score, which is why understanding their impact is crucial.

While the concept of a credit check might seem straightforward, there’s more to it than meets the eye. For example, not all credit checks are created equal. Some have no impact on your credit score, while others can cause a temporary dip. To better understand this distinction, let’s explore the different types of credit inquiries and their implications.

Types of Credit Inquiries: Which Ones Affect Your Score?

When it comes to credit checks, there are two primary types of inquiries: soft and hard. Understanding the difference between them is key to managing your credit score effectively.

Soft Inquiries: What Are They and How Do They Work?

Soft inquiries occur when your credit report is accessed for non-lending purposes. These checks don’t affect your credit score and are often used for background checks, pre-approved credit offers, or when you check your own credit report. Examples of soft inquiries include:

- Employers reviewing your credit history during a job application process.

- Credit card companies sending pre-qualified offers based on your credit profile.

- You checking your credit score through a free credit monitoring service.

Since soft inquiries don’t impact your credit score, they’re considered harmless. However, they are still recorded on your credit report, so you can see who has accessed your information.

Read also:Understanding Caroline Kennedys Illness A Comprehensive Guide

Hard Inquiries: When Do They Occur and Why Do They Matter?

Hard inquiries, on the other hand, happen when you apply for credit or loans, such as mortgages, auto loans, or credit cards. These inquiries are initiated by lenders to assess your creditworthiness and can have a temporary impact on your credit score. Here’s why they matter:

- Each hard inquiry can lower your credit score by a few points.

- Multiple hard inquiries in a short period may signal financial distress to lenders.

- They remain on your credit report for up to two years but only affect your score for the first 12 months.

While hard inquiries are necessary for accessing credit, it’s important to manage them wisely to avoid unnecessary score drops.

How Long Does a Credit Check Affect Your Score?

Now that we’ve covered the types of credit inquiries, let’s address the central question: how long does a credit check affect your score? The duration of a credit check’s impact depends on whether it’s a soft or hard inquiry. Soft inquiries, as mentioned earlier, don’t affect your credit score at all. However, hard inquiries can cause a temporary dip that lasts for about 12 months.

Typically, a single hard inquiry might reduce your credit score by 5 to 10 points. While this may not seem significant, it can matter if you’re on the borderline of qualifying for a loan or credit card. The good news is that the impact diminishes over time. After 12 months, the inquiry no longer affects your credit score, although it remains visible on your credit report for up to two years.

It’s also worth noting that credit scoring models like FICO and VantageScore recognize that consumers may shop around for the best rates. For example, multiple inquiries for the same type of loan (e.g., auto or mortgage) within a short timeframe (usually 14 to 45 days) are treated as a single inquiry. This exception helps minimize the impact of rate shopping on your credit score.

Can Multiple Credit Inquiries Hurt Your Score?

One common concern among consumers is whether multiple credit inquiries can hurt their credit score. The short answer is yes, but the extent of the damage depends on the context. Let’s explore this in detail.

Why Do Multiple Inquiries Raise Red Flags?

Lenders view multiple hard inquiries as a potential sign of financial instability. For instance, if you apply for several credit cards or loans within a short period, it may suggest that you’re desperate for credit or struggling to manage your finances. This perception can lead to a lower credit score and make lenders hesitant to approve your applications.

When Are Multiple Inquiries Not a Problem?

Fortunately, credit scoring models account for situations where multiple inquiries are justified. For example:

- When shopping for a mortgage, auto loan, or student loan, multiple inquiries within a 14 to 45-day window are treated as a single inquiry.

- Soft inquiries, such as those from employers or pre-approval offers, don’t count against your score.

By understanding these nuances, you can avoid unnecessary damage to your credit score while still exploring your financial options.

How to Minimize the Impact of Credit Inquiries?

While credit inquiries are sometimes unavoidable, there are strategies you can use to minimize their impact on your credit score. Here are some practical tips:

- Limit unnecessary applications: Only apply for credit when you truly need it.

- Time your applications wisely: If you’re shopping for a loan, try to complete all applications within a short timeframe.

- Check your credit report regularly: Ensure that all inquiries are legitimate and dispute any unauthorized ones.

By adopting these practices, you can protect your credit score and maintain financial stability.

Does the Impact of Credit Checks Vary by Credit Score?

Another important question is whether the impact of credit checks varies depending on your credit score. The answer is yes, but the difference is usually minimal. Consumers with higher credit scores may experience a smaller drop compared to those with lower scores. This is because individuals with strong credit histories are viewed as less risky, even with a new inquiry.

For example, a person with a credit score of 750 might see a 5-point drop after a hard inquiry, while someone with a score of 650 might lose 10 points. Regardless of your score, the impact is temporary, and responsible credit management can help you recover quickly.

How to Monitor Your Credit Score After a Credit Check?

Monitoring your credit score is essential to understanding how credit checks and other financial activities affect your creditworthiness. Here’s how you can stay on top of your credit health:

- Use free credit monitoring tools like Credit Karma or Experian.

- Review your credit report annually through AnnualCreditReport.com.

- Set up alerts for significant changes to your credit score.

By staying informed, you can take proactive steps to improve your credit score and address any issues promptly.

Frequently Asked Questions About Credit Checks

What Happens If Someone Checks My Credit Without Permission?

If you discover an unauthorized credit check on your report, you should dispute it with the credit bureau. Unauthorized inquiries can indicate identity theft, so it’s crucial to act quickly.

Can I Remove a Hard Inquiry from My Credit Report?

In most cases, hard inquiries cannot be removed unless they’re the result of fraud or error. However, they will naturally fall off your report after two years.

How Can I Improve My Credit Score After a Hard Inquiry?

Focus on maintaining good credit habits, such as paying bills on time, reducing debt, and avoiding new credit applications. Over time, the impact of the inquiry will diminish.

Conclusion

Understanding how long a credit check affects your score is essential for maintaining a healthy credit profile. While hard inquiries can cause a temporary dip, their impact is short-lived and manageable with responsible financial behavior. By monitoring your credit report, limiting unnecessary applications, and taking advantage of rate-shopping exceptions, you can minimize the effects of credit checks on your score.

Remember, your credit score is a dynamic number that reflects your financial decisions. By staying informed and proactive, you can navigate the world of credit checks with confidence and ensure that your score remains strong. Whether you’re applying for a loan or simply monitoring your financial health, this guide equips you with the knowledge to make informed choices.

For more information on credit scores and financial health, visit MyFICO.

Meta Description: Discover how long a credit check affects your score and learn strategies to minimize its impact. This guide covers everything you need to know about credit inquiries and their duration.