Instacash has become a buzzword in the world of financial technology, offering users a quick and hassle-free way to access funds. Whether you're facing an unexpected expense or simply need extra cash to bridge the gap until your next paycheck, Instacash provides a reliable solution. In this article, we will explore everything you need to know about Instacash, from its features and benefits to its eligibility criteria and potential drawbacks. By the end of this guide, you'll have a clear understanding of how Instacash works and whether it's the right financial tool for you.

With the rise of digital lending platforms, Instacash has emerged as a popular choice for individuals seeking immediate financial relief. Unlike traditional loans, Instacash offers a streamlined application process, minimal documentation, and instant approval. This makes it an attractive option for those who need cash quickly without the complications of conventional banking systems. However, it's important to weigh the pros and cons before diving in. In the following sections, we will delve deeper into the mechanics of Instacash, its benefits, and what you should consider before using it.

As with any financial product, understanding the intricacies of Instacash is crucial to making informed decisions. This guide will not only explain how Instacash works but also provide actionable insights and tips to maximize its benefits while minimizing risks. Whether you're a first-time user or someone looking to refine their financial strategy, this article will serve as your go-to resource for all things Instacash. Let's get started!

Read also:Freebird Shaver Review A Comprehensive Guide To Achieve Smooth Hairfree Skin

Table of Contents

- What is Instacash?

- How Does Instacash Work?

- Benefits of Instacash

- Eligibility Criteria for Instacash

- Potential Drawbacks of Instacash

- How to Apply for Instacash

- Tips for Responsible Use of Instacash

- Alternatives to Instacash

- Common Questions About Instacash

- Conclusion

What is Instacash?

Instacash is a financial service offered by various digital lending platforms that allows users to access short-term cash advances quickly and conveniently. It is designed to provide immediate financial relief to individuals who need extra funds to cover unexpected expenses or bridge the gap until their next paycheck. Unlike traditional loans, Instacash does not require extensive documentation or a lengthy approval process, making it an attractive option for those in urgent need of cash.

One of the key features of Instacash is its accessibility. Users can apply for Instacash through mobile apps or websites, and the funds are typically disbursed within minutes or hours. This makes it an ideal solution for emergencies, such as medical bills, car repairs, or other unforeseen expenses. Additionally, Instacash often comes with flexible repayment terms, allowing users to repay the advance over a short period without incurring significant interest charges.

How Instacash Differs from Traditional Loans

While traditional loans involve a lengthy application process, credit checks, and collateral requirements, Instacash simplifies the borrowing experience. Here are some key differences:

- Instacash offers instant approval, whereas traditional loans may take days or weeks to process.

- No collateral is required for Instacash, unlike secured loans that demand assets as security.

- Instacash is typically unsecured, meaning it relies on the user's financial history and income rather than physical assets.

How Does Instacash Work?

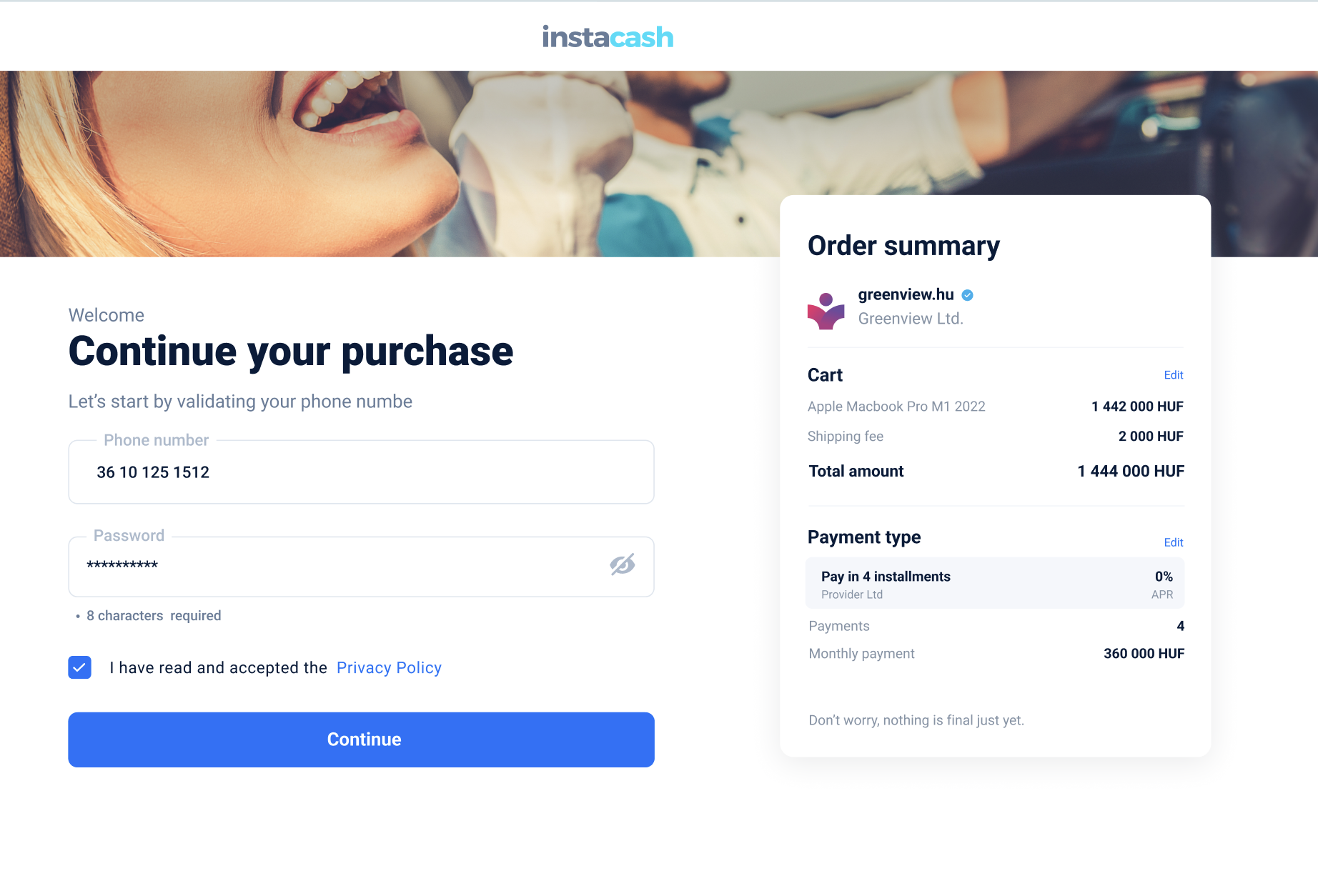

The process of obtaining Instacash is straightforward and user-friendly. To begin, users need to download the app or visit the website of the Instacash provider. Once registered, they will be required to provide basic personal and financial information, such as their income details and bank account information. The platform then evaluates the user's eligibility based on their financial profile and creditworthiness.

After the evaluation, users are informed of the amount they can borrow and the associated fees. If approved, the funds are transferred directly to the user's bank account within a short period. Repayment terms vary depending on the provider, but most Instacash services allow users to repay the advance in installments or as a lump sum on their next payday.

Key Features of Instacash

Here are some notable features of Instacash:

Read also:Tyler The Creator Mother Name Exploring His Family Background And Influence

- Instant Approval: Users can receive funds within minutes of approval.

- No Credit Check: Most Instacash providers do not perform a hard credit check, making it accessible to individuals with lower credit scores.

- Flexible Repayment Options: Users can choose repayment terms that suit their financial situation.

Benefits of Instacash

Instacash offers several advantages that make it a popular choice for individuals seeking immediate financial relief. Below are some of the key benefits:

1. Quick Access to Funds

One of the primary benefits of Instacash is its speed. Unlike traditional loans that require extensive paperwork and approval processes, Instacash provides instant access to funds. This is particularly beneficial for individuals facing emergencies, such as medical bills or urgent home repairs.

2. No Collateral Required

Instacash is an unsecured financial product, meaning users do not need to provide collateral to secure the advance. This reduces the risk for borrowers, as they do not have to worry about losing assets if they fail to repay the loan.

3. Flexible Repayment Options

Most Instacash providers offer flexible repayment terms, allowing users to repay the advance over a short period or as a lump sum. This flexibility ensures that users can manage their finances without feeling overwhelmed by repayment obligations.

4. Accessible to Individuals with Lower Credit Scores

Unlike traditional loans that rely heavily on credit scores, many Instacash providers do not perform hard credit checks. This makes it accessible to individuals with lower credit scores who may struggle to secure loans from banks or other financial institutions.

Eligibility Criteria for Instacash

While Instacash is designed to be accessible to a wide range of users, there are certain eligibility criteria that applicants must meet. These criteria vary depending on the provider but generally include the following:

1. Minimum Age Requirement

Applicants must be at least 18 years old to apply for Instacash. This ensures that users are legally eligible to enter into a financial agreement.

2. Proof of Income

Most Instacash providers require applicants to provide proof of a steady income. This can include pay stubs, bank statements, or other documentation that demonstrates the applicant's ability to repay the advance.

3. Active Bank Account

Users must have an active bank account to receive the funds and facilitate repayment. The account should be in good standing and capable of handling electronic transactions.

4. Residency Requirements

Some Instacash providers may require applicants to be residents of specific countries or regions. This ensures compliance with local regulations and legal requirements.

Potential Drawbacks of Instacash

While Instacash offers numerous benefits, it is essential to consider its potential drawbacks before applying. Here are some factors to keep in mind:

1. High Fees and Interest Rates

Instacash often comes with higher fees and interest rates compared to traditional loans. This is because it is considered a short-term financial product designed for immediate use. Users should carefully review the terms and conditions to understand the total cost of borrowing.

2. Risk of Debt Cycle

Due to its accessibility and ease of use, some users may fall into a cycle of debt by repeatedly borrowing Instacash advances. This can lead to financial strain and difficulty in managing repayments.

3. Limited Loan Amounts

Instacash typically offers smaller loan amounts compared to traditional loans. While this is sufficient for short-term needs, it may not be suitable for larger expenses or long-term financial planning.

How to Apply for Instacash

Applying for Instacash is a simple and straightforward process. Follow these steps to get started:

Step 1: Choose a Reputable Provider

Research and select a trusted Instacash provider. Look for platforms with positive reviews, transparent terms, and a strong reputation in the financial industry.

Step 2: Register an Account

Create an account on the provider's website or mobile app. You will need to provide basic personal information, such as your name, email address, and phone number.

Step 3: Submit Required Documents

Upload the necessary documents, including proof of income and bank account details. Ensure that all information is accurate to avoid delays in the approval process.

Step 4: Await Approval

Once your application is submitted, the provider will evaluate your eligibility. If approved, the funds will be transferred to your bank account within a short period.

Tips for Responsible Use of Instacash

To make the most of Instacash while avoiding potential pitfalls, consider the following tips:

1. Borrow Only What You Need

It's tempting to borrow the maximum amount available, but it's important to borrow only what you need. This will help you manage repayments more effectively and avoid unnecessary fees.

2. Plan Your Repayments

Create a repayment plan to ensure that you can meet your obligations without straining your finances. Consider setting aside a portion of your income specifically for this purpose.

3. Avoid Repeated Borrowing

While Instacash is convenient, relying on it too frequently can lead to financial difficulties. Use it as a short-term solution rather than a long-term financial strategy.

Alternatives to Instacash

If Instacash does not meet your needs or you're looking for other options, consider the following alternatives:

1. Personal Loans

Personal loans from banks or credit unions offer larger loan amounts and lower interest rates compared to Instacash. However, they may require a longer application process and credit checks.

2. Credit Cards

Credit cards can be used for short-term financing and offer the flexibility of revolving credit. However, they often come with high-interest rates if not paid off promptly.

3. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders, offering competitive rates and flexible terms. This can be a viable alternative for those seeking quick access to funds.

Common Questions About Instacash

Here are some frequently asked questions about Instacash:

1. Is Instacash Safe to Use?

Instacash is generally safe to use if you choose a reputable provider. Always research the platform and read user reviews before applying.

2. Can I Use Instacash for Any Purpose?

Yes, Instacash can be used for any purpose, including emergencies, personal expenses, or unexpected bills.

3. What Happens If I Miss a Payment?

Missing a payment can result in late fees and negatively impact your credit score. It's important to communicate with your provider if you anticipate difficulties in making repayments.

Conclusion

Instacash offers a convenient and accessible solution for individuals in need of immediate financial relief. With its quick approval process, minimal documentation, and flexible repayment options, it has become a popular choice for short-term cash advances. However, it's crucial to weigh the benefits against the potential drawbacks, such as high fees and the risk of a debt cycle.

By understanding how Instacash works and following the tips outlined in this guide, you can make informed decisions and use this financial tool responsibly. Whether you're facing an unexpected expense or simply need extra cash, Instacash can be a valuable resource when used wisely. If you found this article helpful, feel free to share it with others or leave a comment below. For more financial insights, explore our other articles on managing personal finances effectively.