Table of Contents

Introduction

Are you looking for a secure and reliable way to grow your savings? In today's uncertain economic climate, finding the right financial tools to safeguard and grow your money is more important than ever. One such tool that has gained popularity is the Certificate of Deposit (CD), and TIAA is a trusted name in the financial industry offering competitive CD rates. Whether you're a seasoned investor or a beginner looking to make your first investment, understanding TIAA CD rates today can help you make informed decisions.

TIAA, or Teachers Insurance and Annuity Association, is a well-established financial institution that caters to the needs of individuals in the academic, medical, and nonprofit sectors. Known for its commitment to financial security and long-term planning, TIAA offers a range of financial products, including CDs, that provide stability and predictable returns. In this article, we will explore TIAA CD rates today, their benefits, and how they compare to other investment options.

By the end of this guide, you will have a clear understanding of how TIAA CDs work, the current rates available, and how you can leverage them to achieve your financial goals. So, let's dive into the details and discover why TIAA CDs might be the perfect choice for your savings strategy.

Read also:Does Queen Latifah Have Kids Exploring Her Personal Life And Legacy

What Are TIAA CD Rates?

Before we delve into the specifics of TIAA CD rates today, it’s essential to understand what a Certificate of Deposit (CD) is and how it works. A CD is a type of savings account offered by banks and credit unions that provides a fixed interest rate over a predetermined period. Unlike regular savings accounts, CDs require you to deposit a lump sum of money and leave it untouched for the agreed-upon term, which can range from a few months to several years.

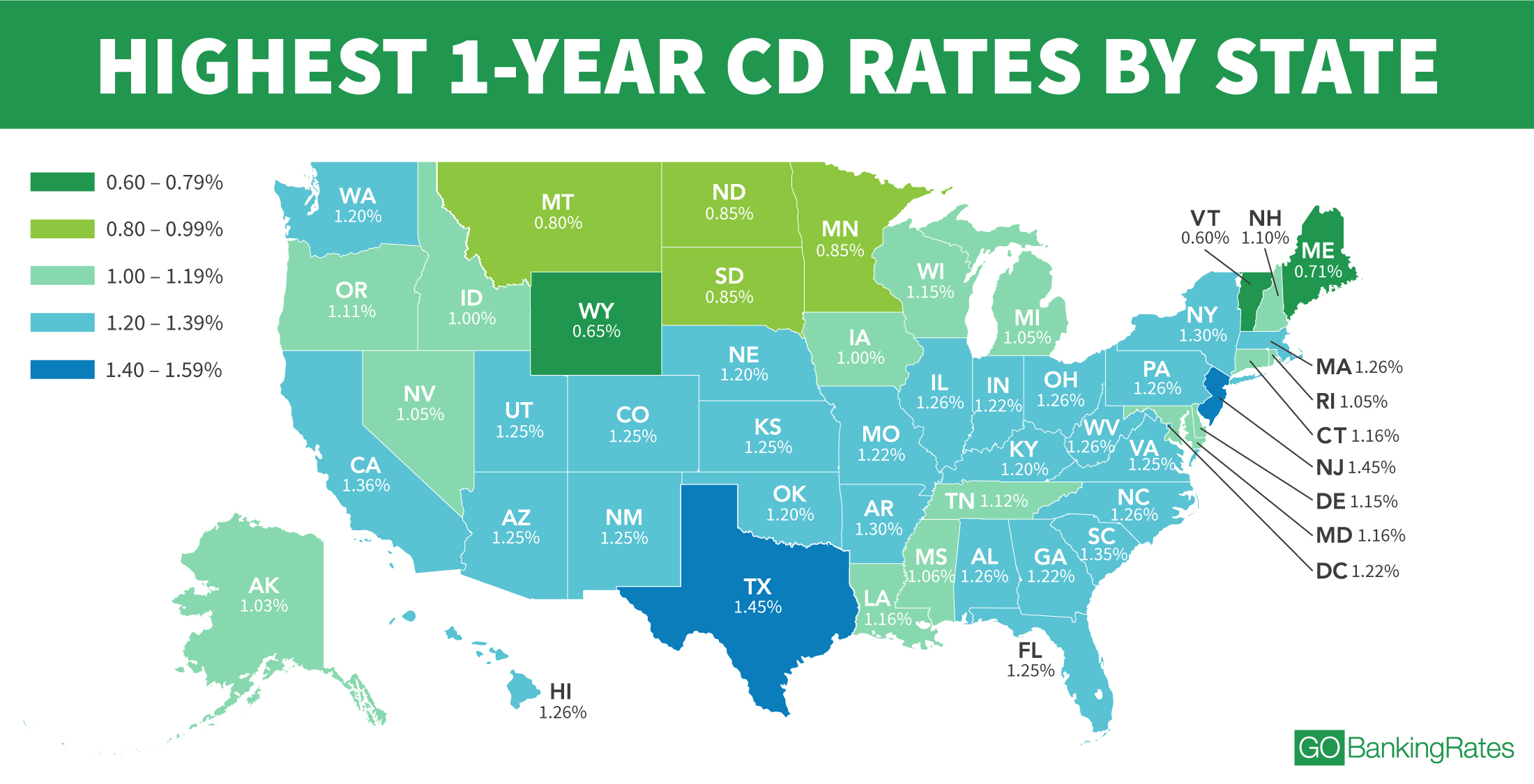

TIAA CD rates refer to the interest rates offered by TIAA on their Certificate of Deposit products. These rates are influenced by various factors, including market conditions, the Federal Reserve’s monetary policy, and the duration of the CD term. TIAA is known for offering competitive rates, especially for individuals in the education and nonprofit sectors, making their CDs an attractive option for long-term savers.

One of the key advantages of TIAA CDs is their predictability. With a fixed interest rate, you know exactly how much your investment will grow over the term of the CD. This stability makes TIAA CDs particularly appealing for those who prioritize financial security and want to avoid the volatility associated with other investment options like stocks or mutual funds.

Why Choose TIAA CDs?

Choosing the right financial product for your savings can be challenging, especially with so many options available in the market. TIAA CDs stand out for several reasons, making them a preferred choice for many investors. Here are some compelling reasons why you should consider TIAA CDs:

- Competitive Interest Rates: TIAA offers some of the most competitive CD rates in the market, ensuring that your money grows steadily over time. These rates are often higher than traditional savings accounts, making CDs a better option for long-term savings.

- Low Risk: CDs are considered one of the safest investment options because they are insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000. This insurance provides peace of mind, knowing that your investment is protected even in the event of a bank failure.

- Predictable Returns: With fixed interest rates, TIAA CDs offer predictable returns, allowing you to plan your financial future with confidence. You’ll know exactly how much your investment will grow over the term, making it easier to budget and plan for major expenses.

In addition to these benefits, TIAA CDs are particularly attractive to individuals in the education, medical, and nonprofit sectors, as TIAA has a long history of serving these communities. Their expertise and understanding of the unique financial needs of these groups make them a trusted partner for long-term financial planning.

Types of TIAA CDs

TIAA offers a variety of CD options to cater to different financial goals and risk tolerances. Understanding the types of TIAA CDs available can help you choose the right product for your needs. Below are the most common types of TIAA CDs:

Read also:Fedezs Girlfriend A Closer Look At The Life And Relationship Of Italys Beloved Power Couple

- Traditional CDs: These are the most common type of CDs, offering a fixed interest rate for a specific term. The interest rate and term are agreed upon at the time of opening the account, and you cannot withdraw the funds before the maturity date without incurring penalties.

- Bump-Up CDs: If you’re concerned about rising interest rates, a bump-up CD might be the right choice for you. This type of CD allows you to request a rate increase if interest rates rise during the term of the CD. However, this option typically comes with a slightly lower initial rate compared to traditional CDs.

- Jumbo CDs: Jumbo CDs are designed for individuals with larger sums of money to invest. These CDs usually require a minimum deposit of $100,000 and often come with higher interest rates than traditional CDs.

Specialty CDs

In addition to the standard CD options, TIAA also offers specialty CDs tailored to specific needs:

- IRA CDs: These CDs are designed for retirement savings and are held within an Individual Retirement Account (IRA). IRA CDs offer tax advantages and are an excellent option for those looking to grow their retirement savings securely.

- No-Penalty CDs: If you’re concerned about liquidity, a no-penalty CD might be the right choice. This type of CD allows you to withdraw your funds before the maturity date without incurring penalties, although the interest rate is typically lower than traditional CDs.

By understanding the different types of TIAA CDs, you can select the product that best aligns with your financial goals and risk tolerance.

Current TIAA CD Rates

One of the most critical factors to consider when investing in a CD is the interest rate. TIAA CD rates today are competitive and vary depending on the term length and the type of CD. Below is an overview of the current TIAA CD rates as of [insert date], along with a comparison of short-term and long-term options:

Short-Term TIAA CD Rates

- 3-Month CD: 3.50% APY

- 6-Month CD: 3.75% APY

- 12-Month CD: 4.00% APY

Long-Term TIAA CD Rates

- 2-Year CD: 4.25% APY

- 3-Year CD: 4.50% APY

- 5-Year CD: 4.75% APY

As you can see, longer-term CDs generally offer higher interest rates, reflecting the commitment required to lock in your funds for an extended period. However, it’s essential to consider your financial goals and liquidity needs before choosing a term length. For example, if you anticipate needing access to your funds in the near future, a short-term CD might be a better option.

TIAA CD rates today are influenced by broader economic factors, such as inflation and the Federal Reserve’s monetary policy. It’s always a good idea to compare TIAA’s rates with other financial institutions to ensure you’re getting the best deal. Additionally, keep an eye on market trends, as rates can fluctuate over time.

How to Open a TIAA CD Account

Opening a TIAA CD account is a straightforward process, but it’s essential to follow the steps carefully to ensure a smooth experience. Below is a step-by-step guide to help you get started:

Step 1: Research and Compare Rates

Before opening a TIAA CD account, take the time to research and compare the current TIAA CD rates with other financial institutions. This will help you determine whether TIAA offers the best deal for your needs. You can find the latest rates on TIAA’s official website or by contacting their customer service team.

Step 2: Choose the Right CD Type and Term

As discussed earlier, TIAA offers a variety of CD options, including traditional, bump-up, and IRA CDs. Consider your financial goals, risk tolerance, and liquidity needs when selecting the type of CD and term length. For example, if you’re looking for long-term growth, a 5-year CD might be the right choice. However, if you need access to your funds sooner, a shorter-term CD would be more appropriate.

Step 3: Gather Required Documentation

To open a TIAA CD account, you’ll need to provide some personal information and documentation. This typically includes:

- Your Social Security Number (SSN)

- Proof of identity (e.g., driver’s license or passport)

- Proof of address (e.g., utility bill or bank statement)

- Funding source (e.g., bank account or check)

Step 4: Apply Online or In-Person

TIAA offers the option to apply for a CD account online or in-person. If you choose to apply online, visit TIAA’s website and follow the instructions to complete the application. If you prefer in-person assistance, you can schedule an appointment with a TIAA representative at one of their branch locations.

Step 5: Fund Your Account

Once your application is approved, you’ll need to fund your CD account. TIAA typically requires a minimum deposit, which varies depending on the type of CD. Ensure that you have sufficient funds available to meet the minimum deposit requirement.

By following these steps, you can successfully open a TIAA CD account and start growing your savings with confidence.

Benefits of TIAA CDs

TIAA CDs offer numerous benefits that make them an attractive option for savers and investors. Below are some of the key advantages of choosing TIAA CDs:

- High Security: TIAA CDs are insured by the FDIC, providing up to $250,000 in protection for your investment. This insurance ensures that your money is safe, even in the event of a bank failure.

- Fixed Interest Rates: With TIAA CDs, you’ll enjoy fixed interest rates that provide predictable returns over the term of the CD. This stability makes it easier to plan for future expenses and achieve your financial goals.

- Competitive Rates: TIAA offers some of the most competitive CD rates in the market, ensuring that your money grows steadily over time. These rates are often higher than traditional savings accounts, making CDs a better option for long-term savings.

- Tax Advantages: If you choose an IRA CD, you can enjoy tax-deferred growth on your investment, allowing you to maximize your retirement savings.

Additional Benefits